The central government of India has introduced the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY). To provide affordable Life Insurance coverage to all the citizens of India who cannot afford won the central government of India started the initiative of PM Jeevan Jyoti Bima Yojana. According to the reports, all the citizens of India who belong to the economically weaker section of the society are the main target of the authority for the scheme. The PM Jeevan Jyoti Bima Yojana covers death from any cause, including natural disasters, accidents, and suicide. The selected citizens are requested to apply for the scheme online by visiting the official website.

About PMJJBY

The Prime Minister of India Mr Narendra Modi announced the PM Jeevan Jyoti Bima Yojana back on 9th May 2015. Under this scheme, the central government will provide Life Insurance coverage of up to INR 2 lakh to all selected citizens. The validity of the life insurance coverage is only one year the citizens will have to renew their insurance after completing the validity period. All the citizens of India who are between the age group of 18 to 55 years are eligible to avail the benefits of the PM Jeevan Jyoti Bima Yojana. The citizen must also have a savings account in any bank to be eligible under the scheme.

Important Factors

| Name of Scheme | Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) |

| Launched By | Central Government of India |

| Date of Launch | May 9, 2015 |

| Beneficiary | Citizens of India |

| Objective of Scheme | Provide Life Insurance coverage |

| Nodal Department | Department of Financial Services |

| State | All States Of India |

| Benefits | Life Insurance coverage of INR to lakh |

| Mode of Application | Offline and online |

| Official Website | https://financialservices.gov.in/ |

Main Objective

The main objective of launching the Pradhan Mantri Jeevan Jyoti Bima Yojana is to provide affordable life insurance to all financially unstable citizens. This scheme will provide financial certainty to all financially unstable families after the death of the member who was selected under the PMJJBY scheme. As per the reports, a total of 16.19 crore citizens of India are already registered under the PM Jeevan Jyoti Bima Yojana scheme. To get the life insurance under the scheme the selected citizen has to pay a total of INR 436 early in the form of premium. The premium amount will be deducted directly from the citizen’s savings account.

Premium Rates

| Month of enrollment | Coverage period | Amount deducted from bank account (INR) | Premium for insurer (INR) | Administrative cost payable to master policyholder (INR) | Commission payable to the distributor (INR) |

| June, July, August | June to May | 436 | 395 | 11 | 30 |

| September, October, November | September to May | 342 | 309 | 10.50 | 22.50 |

| December, January, February | December to May | 228 | 206 | 7 | 15 |

| March, April, May | March to May | 114 | 103 | 3.5 | 7.5 |

Eligibility Criteria

- The applicant must be a permanent resident of India.

- The citizens of India must be between the age group of 18 to 50 years.

- The citizen must have a valid savings account with any participating bank or post office.

- The citizen must have a valid Aadhar card to do the KYC verification and have their Aadhar Card linked with their bank account.

Exclusions Criteria

- The citizens of India do not have to go through any medical tests to enroll under the PMJJBY scheme.

- For new enrollees, insurance cover begins from the date of premium debit, but for the first 30 days, death due to causes other than accidents is not covered.

- The families will not get Coverage, in case the insurer dies due to suicide within 12 months of enrollment.

- The families will not get Coverage, in case of death to pre-existing conditions within the first 45 days of risk cover (lien period).

Silent Features

- Life coverage- With the help of this scheme, the Government of India will provide Life Insurance coverage of up to INR 2 lakh to all the selected citizens.

- Renewable- The coverage period of the life insurance under the scheme is 1 year, the citizens have to renew their life insurance after completing the validity period.

- Financial certainty- By launching this scheme the Government of India is providing financial certainty to all the financially weak households in India.

- Full coverage- The scheme covers death from any cause, including natural disasters, accidents, and suicide.

Required Documents

- Aadhar card

- Bank account details

Insurance Coverage

- The insurance coverage of INR 2 lakh will be given to the selected citizens under the PM Jeevan Jyoti Bima Yojana.

PMJJBY Application Process

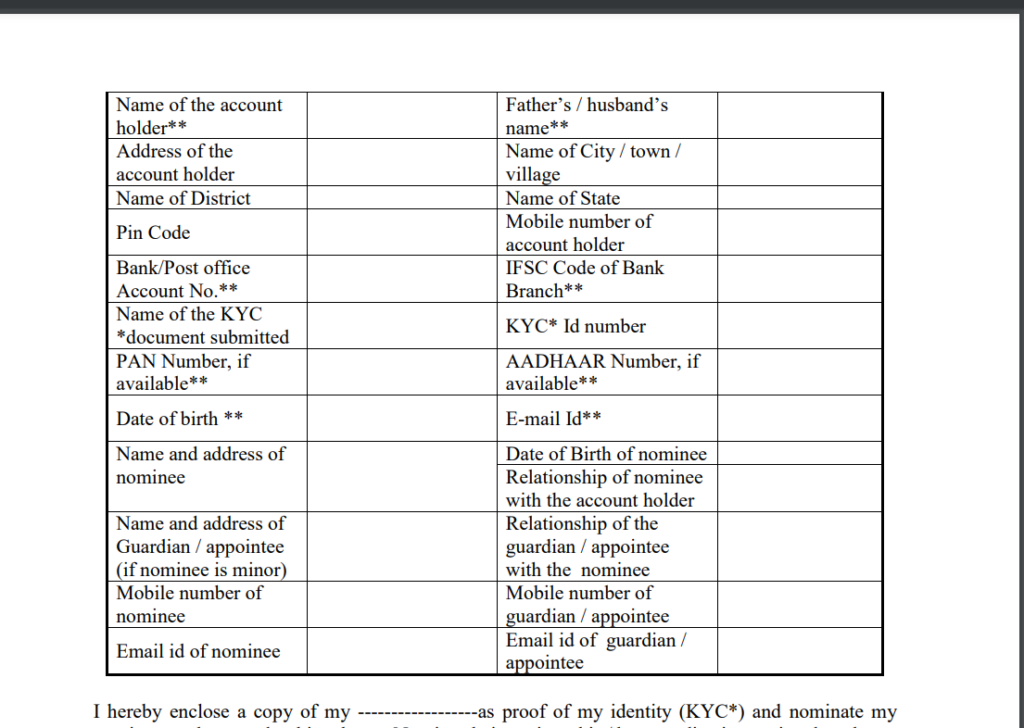

STEP 1: All the citizens of India who want to avail the benefits of the PM Jeevan Jyoti Bima Yojana are requested to visit the bank branch with their Aadhaar card.

STEP 2: Once the citizens reach the nearest bank branch they must consult with the concerned official and ask for the “PMJJBY Application Form”.

STEP 3: After receiving the application form the citizens must start filling it by entering all the details that are asked and attaching all the necessary documents.

STEP 4: Must also give consent for auto-debit of the premium from their savings bank account and “submit” the application form back to the official.

STEP 5: The citizens will now receive the certificate of confirmation that represents that they have successfully registered under the PM Jeevan Jyoti Bima Yojana.

Termination or End of Insurance Coverage

- Once the insured citizen reaches the age of 55 years the insurance coverage will end.

- In case the linked savings bank account is closed or has insufficient balance to maintain the policy the insurance coverage will be terminated.

Claim Process

- Informing the authorities: First of all the family of the ensured citizen must inform their nearest bank branch or post office.

- Document: Now the ensured citizen family must submit all the required documents to the post office or Bank branch including:

- Death certificate of the insured.

- Claim form (available at the bank/post office).

- Original policy document/certificate.

- Identity proof.

- Bank account details.

- Verification: The bank of the post office will verify all the documents and submit the claim to the insurance company.

- Crediting the claim: Once the insurance company completes their own verification and research they will transfer the Insurance claim of INR 2 lakh directly to the nominee’s bank account.

Important Downloads

Contact Details

- If you want more information regarding the Pradhan Mantri Jeevan Jyoti Bima Yojana you can contact on- 1800-180-1111 / 1800-110-001.

FAQs

Who is eligible to available the benefits of the Pradhan Mantri Jeevan Jyoti Bima Yojana?

All the permanent residents of India who are between the age group of 18 to 50 years are eligible to avail the benefits of the Pradhan Mantri Jeevan Jyoti Bima Yojana.

At what age the insurance coverage will expire?

Once the insured citizen reaches the age of 55 years the insurance coverage under the scheme will expire.

What is the annual premium under the Pradhan Mantri Jeevan Jyoti Bima Yojana?

The selected citizens will have to pay an annual premium of INR 436 under the Pradhan Mantri Jeevan Jyoti Bima Yojana.

How much Life Insurance will be given to the selected citizens under the Pradhan Mantri Jeevan Jyoti Bima Yojana?

The life insurance coverage of up to INR 2 lakh will be given to the selected citizens under the Pradhan Mantri Jeevan Jyoti Bima Yojana.

Which nodal department is administrating the works of Pradhan Mantri Jeevan Jyoti Bima Yojana?

Department of Financial Services is administrating the works of Pradhan Mantri Jeevan Jyoti Bima Yojana.

When was the Pradhan Mantri Jeevan Jyoti Bima Yojana launched?

The Pradhan Mantri Jeevan Jyoti Bima Yojana was launched on 9th May 2015.