PMEGP scheme has been launched by the central government of India for the young and new entrepreneurs of India. The Ministry of Micro, Small, and Medium Enterprises (MSME) is in charge of overseeing the credit-linked Prime Minister’s Employment Generation Program scheme known as the PMEGP Scheme. This scheme was introduced in August 2008. Through the creation of micro-enterprises in the non-farm sector, PMEGP seeks to create jobs in both rural and urban areas.

To create jobs by establishing new microbusinesses, projects, and self-employment endeavors in both rural and urban sections of the nation. The purpose of PMEGP is to create jobs in both rural and urban areas by establishing micro-enterprises in the non-farm sector.

Overview of Prime Minister Employment Generation

The Ministry of Micro, Small, and Medium Enterprises is in charge of overseeing the Prime Minister Employment Generation Programme, a central sector program. The Khadi and Village Industries Commission (KVIC) is a government body which is carrying out the program. The State offices of KVIC, State Khadi and Village Industries Boards (KVIBs), District Industries Centers (DICs), Coir Board (for coir-related activities), and Banks are the entities that carry out the program at the State level.

The government may also enlist the help of other appropriate organizations to carry out the plan. After the lock-in period is complete, KVIC routes the government subsidy through the nodal Bank to the Financing Bank branches and then transfers it to the beneficiary account.

Important Factors

| Name of the scheme | PMEGP scheme |

| Launched by | Ministry of Micro, small and Medium Enterprises |

| Beneficiaries | Citizens of the Country |

| Benefits | Under this scheme the government will provide financial assistance to the young entrepreneurs |

| Application Mode | Both Offline and Online |

| Year | 2024-25 |

| Official website | MSME Portal |

Objective of PMEGP Scheme

The Primary objective of the PGEMP program is to create jobs by creating new small businesses, initiatives, and self-employment ventures in both rural and urban sections of the nation. To bring together a variety of traditional artisans, and youngsters without jobs in rural and urban areas. To provide them with options for self-employment at their location. This program will stop the migration of young people from rural areas to urban areas by giving them consistent and sustained work or employment. This program will help to raise the capacity of workers and craftsmen to earn a living and to help increase the rate of employment growth in both rural and urban areas.

Salient Features

Margin Cash Bonus:- Money will be allotted under the yearly budget estimates to disburse Margin Money, or subsidies, to new microenterprises and units.

Forward and Backward Connections:- A portion of the total funds allocated under BE for a financial year against PMEGP, or as authorized by the relevant authority, shall be set aside as funds under Backward and Forward Linkages.

Support:- These funds will be used to support the establishment of new micro-enterprises (units) through PMEGP, including awareness camps, workshops, exhibitions, bankers’ meetings, and level monitoring meetings at the state and district levels.

Subsidy:- The beneficiary’s contribution (of project cost) will be allocated under PMEGP. Ten Percent 15% for urban areas and 25% for rural areas is the project cost subsidy rate.

Eligibility Criteria for New Enterprises

- Any individual, above 18 years of age.

- There will be no income ceiling for assistance in setting up projects under PMEGP.

- For setting up of project costing above Rs.10 lakh in the Manufacturing sector and above ₹ 5,00,000 in the Business /Service sector, the beneficiaries should possess at least VIII standard pass educational qualification.

- Assistance under the scheme is available only for new projects sanctioned specifically under the PMEGP.

- Existing Units (under PMRY, REGP, or any other scheme of the Government of India or State Government) and the units that have already availed of Government Subsidy under any other scheme of the Government of India or State Government are not eligible.

Exclusion Criteria

For PMEGP new enterprises (Units):

Existing Units (under PMRY, REGP, or any other scheme of the Government of India or State Government) and the units that have already availed of Government Subsidy under any other scheme of the Government of India or State Government are not eligible.

Only one person from one family is eligible for obtaining financial assistance for setting up of projects under PMEGP. The ‘family’ includes self and spouse.

Negative List of Activities:

The following list of activities will not be permitted under PMEGP for setting up of micro-enterprises/ projects/units: –

Any Industry/ Business connected with Meat(slaughtered), i.e., processing, canning, and/or serving items made of it as food, production/Manufacturing or sale of intoxicant items like Beedi/Pan/ Cigar/Cigarette, etc., any Hotel or Dhaba or sales outlet serving liquor, preparation/producing tobacco as raw materials, tapping of toddy for sale will not be allowed.

Any Industry/Business connected with the cultivation of crops/plantations like Tea, Coffee, Rubber, etc. Sericulture (Cocoon rearing), Horticulture, Floriculture, and Animal Husbandry will not be allowed. However, value addition under these will be allowed under PMEGP. Farm/Farm Linked activities in connection with sericulture, horticulture, floriculture, etc. will also be allowed.

Activities prohibited by Local Government/Authorities keeping in view environment or socio-economic factors will not be allowed.

Other Eligibility Criteria

- Projects without Capital Expenditure are not eligible for Financing under the Scheme.

- The cost of the land should not be included in the Project cost. Cost of the ready-built shed as well as long lease or rental. Work shed/Workshop can be included in the project cost subject to restricting such cost of ready built as well as long lease or rental work shed/workshop to be included in the project cost calculated for a maximum period of 3 years only.

- PMEGP applies to all new viable microenterprises, including Village Industries projects except activities prohibited by local Government/Authorities keeping in view environmental or socio-economic factors and activities indicated in the negative list of the guidelines (Para 30 of the guidelines).

Trading activities;

- Business / Trading activities in the form of sales outlets may be permitted in NER, Left-wing Extremism (LWE)-affected districts and A & N Islands.

- Retail outlets/Businesses – selling Khadi products, Village Industry products procured from Khadi and Village Industry Institutions certified by KVIC, and products manufactured by PMEGP units and SFURTI clusters only may be permitted under PMEGP across the country.

- Retail outlets backed by Manufacturing (including processing) / Service facilities may be permitted across the country.

- The maximum cost of the project for Business / Trading activities as above [(a) and (b)] may be Rs.20 lakh (at par with the maximum project cost for the Service sector).

- A maximum 10% of the financial allocation in a year in a state may be used for Business / Trading activities as above [(a), (b), and (c)].

- Transport activities -Transport activities viz purchase of Cab/Van/ Boat/Motorboat/Shikara, etc. for transportation of tourists or the general public will be allowed.

- A ceiling of 10% on the extent of projects financed under transport activities is applicable in all areas except NER, Hilly region, LWE-affected districts, and A & N Islands, Goa, Puducherry, Daman & Diu, Dadra Nagar Haveli, J&K, Lakshadweep, or other specific areas as may be declared so by the Government.

- All new units’ setup under PMEGP will be mandatorily registered under Udyam Portal before Physical Verification of the Unit and the adjustment of the Margin Money in the PMEGP beneficiary loan account.

Required Documents

- Caste Certificate

- Special Category Certificate, wherever required

- Rural Area Certificate

- Project Report

- Education / EDP / Skill Development Training Certificate

- Any other applicable document

Financial Institutions Under PMEGP Scheme

- All Public Sector Banks All Regional Rural Banks, Co-operative Banks,

- Commercial Banks regulated by RBI Small Industries Development Bank of India (SIDBI).

Bank Finance

- The Bank will sanction 90% of the project cost in case of the General Category of the beneficiary and 95% in case of the Special Category of the beneficiary and disburse the full amount suitably for setting up of the project.

- Bank will finance Capital Expenditure in the form of a Term Loan and Working Capital in the form of cash credit.

- The project can also be financed by the Bank in the form of a composite loan consisting of Capital Expenditure and Working Capital. 8.2 8-3 Maximum project cost under PMEGP is Rs. 50 lakhs, which includes a Term Loan for Capital Expenditure and Working Capital.

- For Manufacturing units, Working Capital component should not be more than 40% of the project cost and for units under the Service/Trading sector, the Working Capital shall not be more than 60% of the project cost.

- However, for the projects where the Capital Expenditure reaches the maximum ceiling of the project cost for Manufacturing/ Service sector units, the Bank can consider sanctioning of additional funds over and above Rs. 50 Lakhs and Rs. 20 Lakhs respectively.

- In such cases, the additional funds over and above Rs.50 lakh/20 lakh will not be covered for subsidy.

- In case the incurred Capital Expenditure and Working Capital Expenditure (at the end of the third year from the commencement of production) is less than the sanctioned amount under the Bank loan (including own contribution), the excess Margin Money(subsidy) (against the shortfall) shall be refunded to KVIC.

Identification of Beneficiary

- The State/district level implementation authorities and Banks will identify the recipients at the district level.

- Bankers must be involved from the outset to prevent application bunching.

- The candidates, who have already completed at least 60 hours of online training or 10 days of offline instruction \within the Skill Development Program and the Entrepreneurship Development Program (EDP) (SDP) or Vocational Training combined with Entrepreneurship and Skill Development Program (ESDP) (VT) does not have to retake the EDP training.

- Priority will be granted to those impacted by natural disasters in the areas which are deemed to be impacted by a “disaster” as that term is defined in Section 2(d) of the Disaster Management Act of 2005 issued by the Home Affairs Ministry.

Interest Rate and Repayment

- The normal rate of interest shall be charged. Repayment schedule may range between 3 to 7 years after an initial moratorium as may be prescribed by the concerned Bank/financial institution.

- RBI has issued necessary guidelines to the Banks to accord priority in sanctioning projects under PMEGP. RBI also issues suitable guidelines from time to time as to which RRBs and other Banks will be excluded from implementing the scheme.

Project Cost Under PMEGP Scheme

- 1. For setting up new micro-enterprises (units)

- a) Categories of beneficiaries under PMEGP Scheme (for setting up of new enterprises): General Category

- Beneficiary’s contribution (of project cost): 10% Rate of Subsidy (of project cost): 15% for Urban Areas, 25% for Rural Areas.

- b) Categories of beneficiaries under PMEGP (for setting up of new enterprises): Special Category (including SC, ST, OBC, Minorities, Women, Ex-Servicemen, Transgenders, differently abled, NER, Aspirational Districts, Hill and Border areas (as notified by the Government), etc.

- (i) Beneficiary’s contribution (of project cost): 05%

- (ii) Rate of Subsidy (of project cost): 25% for Urban Areas, 35% for Rural Areas.

Note:

- The maximum cost of the project/unit admissible for Margin Money subsidy under the Manufacturing sector is ₹50,00,000.

- The maximum cost of the project/unit admissible for the Margin Money subsidy under the Business/Service sector is ₹20,00,000.

- The balance amount (excluding the own contribution) of the total project cost will be provided by Banks.

- If the total project cost exceeds ₹50,00,000 or ₹20,00,000 for the Manufacturing and Service/Business sectors respectively, the balance amount may be provided by Banks without any Government subsidy.

2. 2nd Loan for Upgradation of Existing PMEGP / REGP / MUDRA Units

- a) Categories of beneficiaries under PMEGP (for upgradation of existing units): All Categories

- b) Beneficiary’s contribution (of project cost): 10%

- c) Rate of Subsidy (of project cost): 15% (20% in NER and Hill States).

- Note:

- 1) The maximum cost of the project/unit admissible for Margin Money subsidy under the Manufacturing sector for upgradation is ₹10,00,00,000. The maximum subsidy would be ₹15,00,000 (₹20,00,000 for NER and Hill States).

- 2) The maximum cost of the project/unit admissible for Margin Money subsidy under the Business/Service sector for upgradation is ₹25,00,000. The maximum subsidy would be ₹3,75,000 (₹5,00,000 for NER and Hill States).

- 3) The balance amount (excluding the own contribution) of the total project cost will be provided by Banks.

- 4) If the total project cost exceeds ₹10,00,00,000 or ₹25,00,000 for the Manufacturing and Service/Business sectors respectively, the balance amount may be provided by banks without any Government subsidy.

PMEGP Online Application Process

1. Application For New Unit

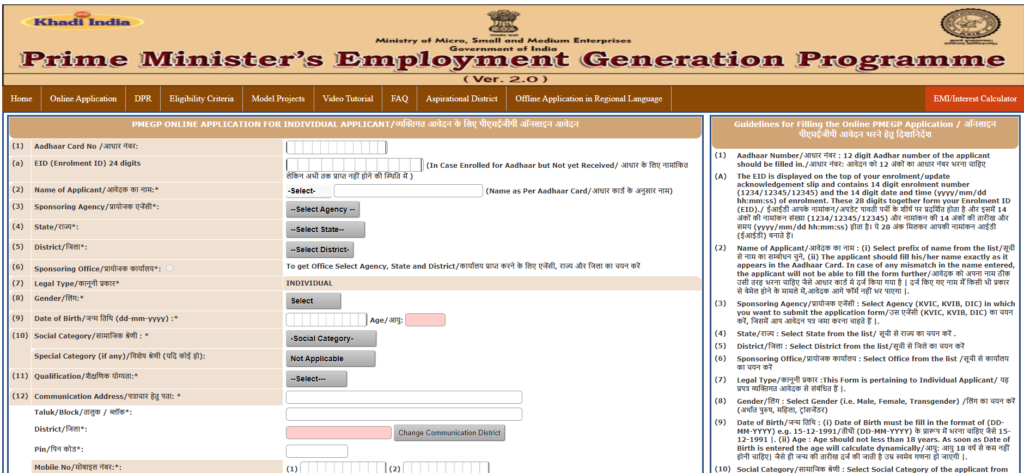

Step 1: Visit the Official PMEGP Website.

Step 2: Click on the “Apply” button under the “Application For New Unit” tab.

Step 3: Furnish all the required details and click on Save Applicant Data.

Step 4: On the next page, upload the required documents and proceed for final submission.

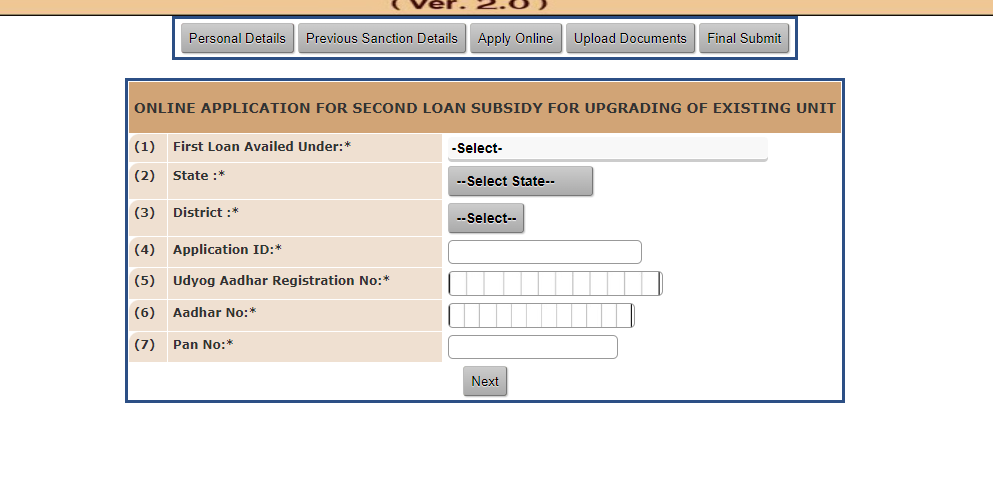

2. Application For Existing Units (2nd Loan)

Step 1: Visit the official website.

Step 2: Click on the “Apply” button under “Application For Existing Units (2nd Loan)” tab.

Step 3: Click on the Online Application tab and fill out the complete form on.

Step 4: Complete the form and click on the Next page, upload the required documents, and proceed to final submission.

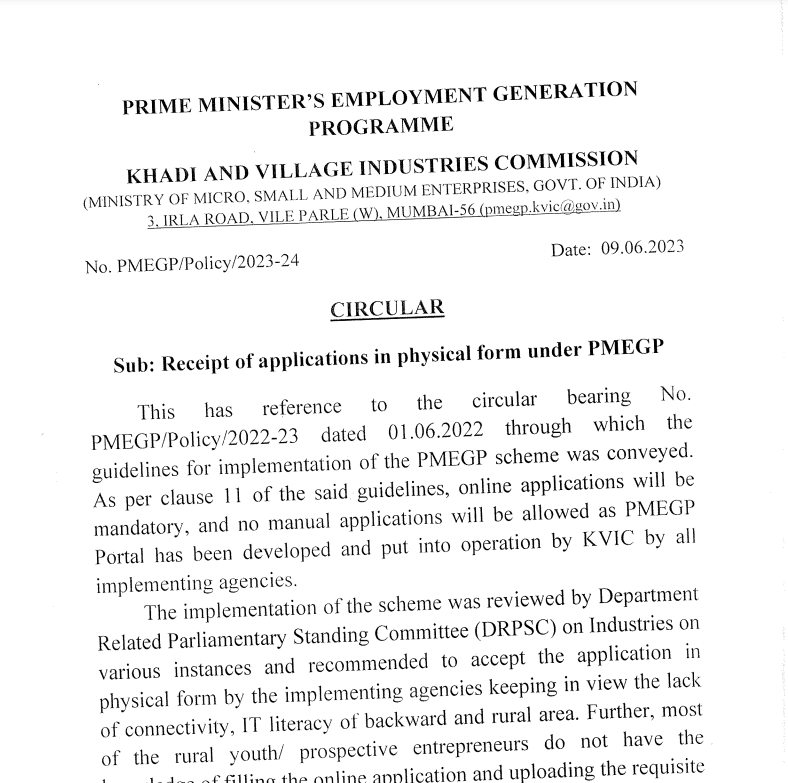

PMEGP Offline Application Process

- Fill out the complete PMEGP Application form.

- The filled original form shall be submitted to the concerned KVIC/KVIB/DIC/Coir Board Officers of State.

- On submission, the applicant shall receive the acknowledgment slip from the department of concerned KVIC/KVIB/DIC/Coir Board Office.

Important Downloads

FAQS

What is PMEGP scheme?

PMEGP scheme has been launched by the central government of India for the young and new entrepreneurs of India.

Who launched this scheme?

The Ministry of Micro, Small, and Medium Enterprises (MSME) is in charge of overseeing the credit-linked Prime Minister’s Employment Generation Program scheme known as the PMEGP Scheme

What are the benefits of this scheme?

Through the creation of micro-enterprises in the non-farm sector, PMEGP seeks to create jobs in both rural and urban areas.

Who can apply for this scheme?

Any individual, above 18 years of age.

What Is Maximum Project Cost Allowed Under PMEGP?

Rs.25.00 lakhs for the manufacturing unit and Rs.10.00 lakhs for Service Unit.

Which ministry controls this program?

The Ministry of Micro, small and medium enterprises.