The Department of Economic Affairs, Ministry of Finance, introduced the Mahila Samman Savings Certificate initiative to give every Indian girl and woman financial security. Using an electronic notification published in the Gazette on June 27, 2023. The Department of Economic Affairs under the Ministry of Finance granted permission to all Public Sector Banks and qualified Private Sector Banks to carry out and start the Mahila Samman Savings Certificate. This attempts to give women and girls better access to the program. As a result, post offices and qualified Scheduled Banks will now be able to subscribe to the “Mahila Samman Savings Certificate” scheme.

About Mahila Samman Savings Certificate

The government of India has taken an amazing step to empower women and ensure their financial stability through the Mahila Samman Savings Certificate or Mahila Samman Nidhi. Introduced in April 2023 as a component of the festivities surrounding Azadi ka Amrit Mahotsav, this little savings plan offers a special chance for women from all walks of life. A risk-free program aimed at women and girls of all ages is the Mahila Samman Savings Certificate. The purpose of this program is to encourage girls and women to save and make investments. It is recommended that the account opened under this plan be of the single-holder variety.

Important Factors

| Name of the article | Mahila Samman Savings Certificate |

| Launched by | The government of India |

| Beneficiaries | The women citizens of India |

| Objective of the scheme | This scheme will empower the women in the country |

| Nodal Department | Department of Economic Affairs, Ministry of Finance |

| Mode of application | Online and offline |

| Official website | https://dea.gov.in/ |

Objective

The primary objective of the Mahila Samman Savings Certificate is to ensure the safety of women financially. This scheme has been mainly launched by the Central government for the benefit of the women in India. This program is open to all women, including married women, widows, and women with disabilities. Under this initiative, people can deposit up to Rs. 2 lakhs at a set interest rate in the name of a woman or girl for a maximum of two years. This program aims to promote saving and investing among women and girls. This scheme will for sure help the women become financially independent.

Eligibility Criteria

- The applicants need to be citizens of India.

- Only women and young girls are eligible for this program.

- Any individual woman is eligible to apply for the program.

- The guardian may also open the minor account.

- Women of all ages are eligible to participate in this plan, and there is no maximum age.

Salient Features

- Investment security: Gives all women and girls access to safe and appealing investment opportunities.

- Flexible application: Accounts under this plan may be opened for two years on or before March 31, 2025.

- Quarterly interest deposits: Interest on deposits made under the MSSC will be paid at a quarterly compound rate of 7.5% annually.

- Very low investment: Any amount in multiples of 100 may be placed, with a minimum of ₹1,000 and a maximum of ₹2,00,000.

- Short maturity period: Two years from the account opening date under the scheme is the investment maturity period under this scheme.

- Flexible Withdrawals: Throughout the scheme’s duration, it allows for flexibility in both partial withdrawals and investments.

Minimum and Maximum Amount

- An account may be deposited with a minimum of ₹1000/-and any amount in multiples of one hundred rupees; however, further deposits will not be accepted in that account.

- An account holder may deposit up to ₹2,00,000/-into one or more of their accounts.

Required Documents

- The applicant’s identity proof (passport, Voter ID card, PAN card)

- The applicant’s proof of residence (water bill, electricity bill, rent agreement, etc.)

- Passport size photo

- Email address and a valid phone number.

Interest Rate

- Interest will be paid on deposits made under the MSSC Saving Scheme at a rate of 7.5% annually, compounded quarterly.

Mahila Savings Samman Calculator (MSSC)

The Mahila Savings Samman Yojana uses a simple interest formula to calculate the maturity amount, based on the deposit, interest rate, and time period (in years).

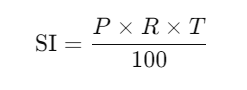

Formula for Simple Interest (SI):

Where:

- ( P ) = Principal amount (initial deposit)

- ( R ) = Rate of interest per annum (as a percentage)

- ( T ) = Time period in years

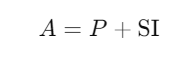

Maturity Amount (A):

Where:

- ( A ) = Maturity amount (total amount received at the end of the term)

- ( P ) = Principal amount (initial deposit)

- ( SI ) = Simple interest earned over the time period

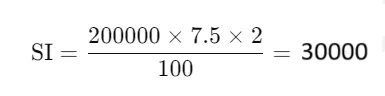

Example Calculation:

If you deposit ₹2,00,000 for 2 years at an interest rate of 7.5%:

- Principal (P) = ₹2,00,000

- Interest Rate (R) = 7.5% per annum

- Time (T) = 2 years

Step-by-Step Calculation:

- Calculate Simple Interest:

- Total Interest (for 2 years) = ₹30,000

- Maturity Amount (A) = ₹2,00,000 (Principal) + ₹30,000 (Interest) = ₹2,30,000

So, the maturity amount after 2 years is ₹2,30,000.

MSSC Calculator

| Amount | Amount in Rs |

|---|---|

| Total Deposit Amount | ₹ 0.00 |

| Total Interest | ₹ 0.00 |

| Maturity Amount | ₹ 0.00 |

*Maturity amount shown here is indicative only. Subject to change based on the interest rate advised by the Government from time to time.

This is how the Mahila Savings Samman Yojana calculator works, using simple interest to determine the total interest earned and the final maturity amount.

Maturity and Withdrawal

- The deposit is due to mature after two years, at which point the account holder may receive payment of the eligible balance.

- The account user will have the ability to withdraw a maximum of forty percent of the Eligible Balance once the account has been open for a year but before it matures.

- If a minor girl’s account was opened on her behalf, her guardian may request a withdrawal on her behalf by bringing the appropriate certificate to the accounts office.

- Any amount in fractions of a rupee will be rounded to the closest rupee for determining the withdrawal from the account, and for this reason, any amount beyond fifty paisa will be considered one rupee, while any amount below fifty paisa will be disregarded.

Premature Closure

- An MSSC account can be opened for a maximum of two years, and it cannot be closed before that time unless one of the following circumstances occurs:

- When an account holder passes away and the bank is satisfied that the account holder is suffering undue hardship due to the operation or continuation of the account—for example, due to medical support for a life-threatening illness or the death of a guardian—it may, upon thorough documentation, by order, and for reasons documented in writing, permit the account to be closed early. Interest on the principal amount of an account that is closed early will be paid at the rate that is applicable to the scheme that the account has been held for (without net of any interest that may be owed).

- Any time after the six months have passed since the account was opened for any of the other reasons listed above, an account may be prematurely closed. In this scenario, the balance in the account as of any given time will only be eligible for interest at a rate that is two percent (2%) less than the scheme’s specified rate.

Benefits

- The only people eligible to receive a Mahila Samman Savings Certificate are women or girls under the age of 18.

- In the name of the beneficiary, any woman or a minor girl’s legal guardian may open an MSSC account.

- A government-backed one-time small savings program is called MSSC. As such, there is no credit risk associated with it.

- Under the MSSC, deposits can be made as little as Rs. 1000 and as much as Rs. 2 lakhs.

- One year from the date of account opening, the account holder may make a partial withdrawal from the MSSC plan.

- The interest rate offered by this scheme is 7.5% p.a., which is more than most banks and fixed-rate accounts offer.

Application Process

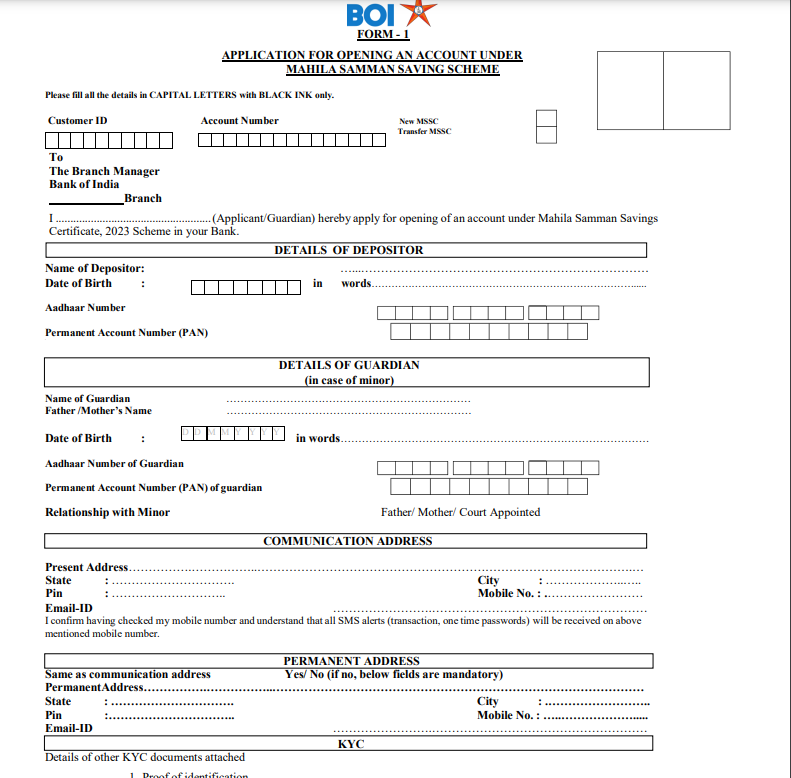

Step 1: The candidate may go to a specified bank or the closest Post Office branch.

Step 2: Pick up the application in person or get it on the official Bank Of India website.

Step 3: Complete the application and affix the necessary paperwork.

Step 4: Complete the nomination and declaration forms.

Step 5: Apply together with the deposit or initial investment amount.

Step 6: Get the certificate proving your participation in the “Mahila Samman Savings Certificate” program.

Note: On or before March 31, 2025, a woman may apply to open an account under this Scheme on her behalf, or a minor girl’s guardian may do so.

Download Application Form

FAQS

What is the Mahila Samman Savings Certificate?

The Department of Economic Affairs, Ministry of Finance, introduced the Mahila Samman Savings Certificate initiative to give every Indian girl and woman financial security.

Who launched this scheme?

The central government of India

Who is eligible for this scheme?

The applicants need to be citizens of India. Only women and young girls are eligible for this program.

What is the minimum investment for this scheme?

An account may be deposited with a minimum of ₹1000/-and any amount in multiples of one hundred rupees; however, further deposits will not be accepted in that account.

What is the maturity period for this scheme?

The deposit is due to mature after two years, at which point the account holder may receive payment of the eligible balance.

Can we withdraw money from our deposit before maturity?

When an account holder passes away and the bank is satisfied that the account holder is suffering undue hardship due to the operation or continuation of the account.