The Government of India launched the Kisan Credit Card Scheme (KCC). To provide timely and affordable credit facilities to all the farmers of India so that they can fulfill their agriculture needs the central government of India started the Kisan Credit Card Scheme (KCC). With the help of this scheme, the financially unstable farmers of India are eligible to receive short-term loans from the government. The interest rate on short-term loans is comparatively more affordable than any other loan. All the citizens of India who are farmers by profession are eligible to fill out the application form online and avail the benefits of the Kisan Credit Card Scheme (KCC).

Overview of KCC

The Kisan Credit Card Scheme (KCC) was originally launched by the government of India in August 1998. With the help of this scheme, the farmers are eligible to get short-term loans of up to INR 1.60 lakh to INR 3 lakh. According to the government, the loans under the scheme come with a subsidized interest rate that makes the repayment process easy and affordable for the farmers. The amount of loan under the scheme is based on various factors that include crop type, cultivated area, post-harvest/household expenses, farm asset maintenance, and crop insurance.

Important Factors

| Name of Scheme | Kisan Credit Card Scheme (KCC) |

| Launched By | Government of India |

| Date of Launch | August 1998 |

| Beneficiary | Farmers |

| Objective of Scheme | Provide loans |

| Nodal Department | Ministry of Agriculture and Farmers Welfare |

| State | All states of India |

| Benefits | Provide short-term loans |

| Mode of Application | Online/ Offline |

Objective

The main objective of launching the Kisan Credit Card Scheme is to eliminate all the financial troubles that are faced by the farmers of India. To get any short-term loan under the scheme the farmers did not have to submit any collateral fees or assets. The KCC card also comes with an ATM-cum-debit card to make easy cash withdrawals. To make the loan more simple and affordable for the farmers the farmers can opt for the option to repay the loan after the harvest. In case of natural calamities, the farmers can also reschedule their repayment.

Eligibility Criteria

- The applicants must be a permanent resident of India.

- The citizens must be a farmer by profession.

- The farmers must be between the age group of 18 to 75 years.

- The farmers must have agricultural land for the purpose of cultivation.

- The farmers must also have a savings bank account.

- The farmers must also have a well-structured plan for crop production.

Silent Features

- Short-term loan- By launching this scheme the central government of India will provide short-term loan facilities to all the farmers of India. The loan amount from INR 1.60 lakh to INR 3 lakh is available for the farmers.

- No collateral- To avail these loans the farmers did not have to pay any kind of collateral fees or money.

- ATM-cum-debit card- The Government of India will also provide an ATM-cum-debit card to all the KCC cardholders to encourage the farmers to perform cashless transactions.

- Affordable interest rates- The interest rate on the loan amount under the scheme is very affordable and subsidized by the government to make the payment process easy.

- Subsidy on agriculture supplies- All the farmers who hold a KCC card are eligible to receive subsidies on the purchase of various agricultural supplies.

Credit Limit (Loan Amount)

- Short Term Limit for First Year: Under the category, the loan amount will be given to the farmers based on their crop expenses with an extra amount for post-harvester, repair, and insurance for their cultivation.

- Limit for Second & Subsequent Years: For the second and subsequent years, the first year’s loan limit is increased by 10% for cost hikes and added term loans for 5 more years.

- For cultivating more than one crop per year: Assuming that the farmers use the same cropping pattern every year they will receive a 10% increase every year on the principal amount of 1st year. In case the farmer produces a different crop he will be adjusted according to the crop.

- Term Loan for Investment: The loans under the scheme will be given to the farmers on the basis of farm investment like equipment and land improvement and on the repayment ability of the farmers.

- Maximum Permissible Limit (MPL): In the 5th year, authorities will calculate the short-term loan needed and any long-term loan. The total of these two amounts is the maximum permissible limit for all the farmers under the scheme.

- Fixation of Sub-limits: To manage the loan limits easily and make the repayment affordable for the farmers the authorities have split the loan limits between short-term cash credit and term loans.

- For Marginal Farmers: The authorities are providing flexible loans of INR 10,000 to 50,000 through Flexi KCC for all the farmers with small land. With the help of these loans the farmers can carry out various expenses that occur on the form like storage and personal needs.

Required Documents

- Filled application form

- Passport photos (2)

- ID proof (Aadhaar, Voter ID, etc.)

- Address proof

- Landholding proof (certified by revenue authority)

- Cropping pattern details

- Security documents (land ownership, mortgage deeds)

- Land records

- Income tax returns

- Project reports (allied activities)

- Additional (Bank Specific) For Higher Loan Amounts

Benefits of Kisan Credit Card

- The farmers can purchase various farming equipment with the help of the credit facility given under the Kisan Credit Card.

- The interest rate under the Kisan Credit Card is 2% to 4%b which is comparatively lower than any other loan scheme for farmers.

- The farmers can pay back their loans in short and small installments easing the financial burden on the farmers.

- The authorities will also provide personal accident insurance coverage to all Kisan credit card holders.

- The farmers can significantly enhance their farming efficiency by getting the latest technology equipment without worrying about financial trouble.

Interest Rates

- The rate of interest will be as stipulated in DBR Master Directions on Interest Rate on Advances.

Repayment Period

- The repayment period will be fixed by the banks according to the anticipated harvesting date and marketing period for the crops for which the loan is given

- The term loan component will be normally repayable within 5 years depending on the type of activity/investment as per the existing guidelines applicable for investment credit.

- According to the type of investment, the financing banks may provide a longer repair and period for the term loan.

KCC Application Process

STEP 1: All the farmers of India who want to apply for the scheme can visit the official website of any Bank they want to apply with, here let’s take an example of the Bank of India.

STEP 2: Once the farmers reach the homepage of the official website they must click on the option called “Kisan Credit Card (KCC)” under the heading “AGRI” available on the dashboard.

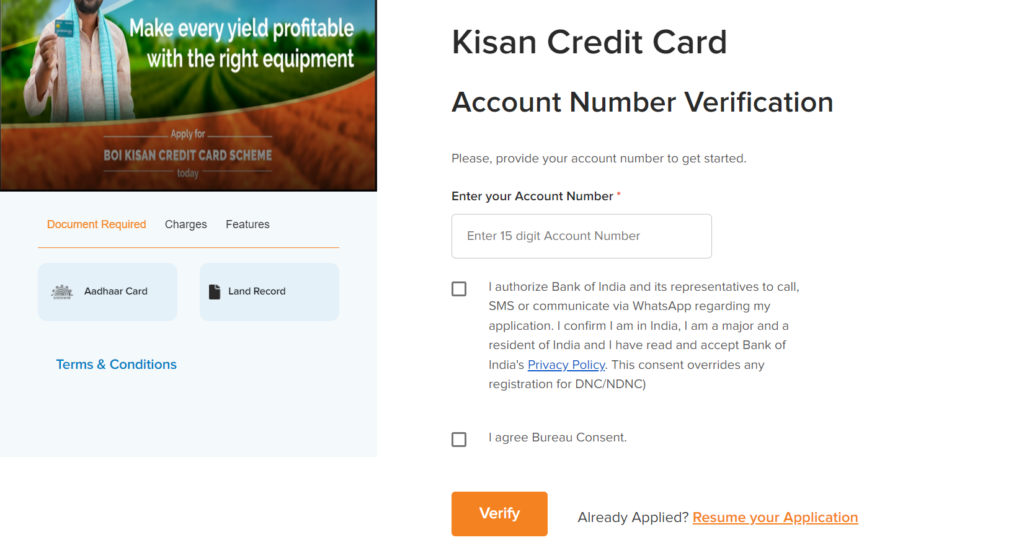

STEP 3: A new page will appear on your desktop screen the farmers must scroll down and click on the option called “Apply Now”.

STEP 4: Now the new page the farmers must enter their bank account number and click on the option called “Verify.

STEP 5: Now the application form page will appear on your desktop screen the farmers must enter their details and land/crop details.

STEP 6: After entering all the details the farmers must quickly review it and click on the option called “submit”.

STEP 7: After submission, the farmers will receive an application reference number as confirmation that the bank has received your application. Keep this number for future reference and tracking purposes.

STEP 8: If the farmers clear the eligibility criteria the bank authorities will call them for other kinds of verification and KYC.

Offline Procedure

STEP 1: All the farmers of India who want to apply for the Kisan Credit Card Scheme (KCC) offline are requested to visit any bank branch according to their choice.

STEP 2: Once the farmer reaches the bank branch they must visit the customer service desk and inform them of their intention to apply for the Kisan Credit Card scheme.

STEP 3: After Consulting with the bank official, the bank official will ask for certain documents the farmers must give all the documents that they are asked for.

STEP 4: Now the bank official will provide you with the application form the farmers must fill out all the details that are asked on the application form.

STEP 5: After entering all the details the farmers must quickly review it and submit the application form back to the government official.

STEP 6: The bank will process your application. The bank authority will give the farmers an application reference number to track their application status. The farmers are advised to visit the bank frequently to receive every update regarding their application..

Important Form Download

| Bank Name | Form Download Link |

|---|---|

| State Bank of India (SBI) | SBI KCC Form |

| Punjab National Bank (PNB) | PNB KCC Form |

| Bank of Baroda (BoB) | BoB KCC Form |

| HDFC Bank | HDFC KCC Form |

| ICICI Bank | ICICI KCC Form |

| Axis Bank | Axis KCC Form |

| Canara Bank | Canara KCC Form |

| Union Bank of India | Union Bank KCC Form |

Contact Details

- The farmers can contact the helpline number of the bank from which they have applied for the Kisan Credit Card Scheme (KCC).

FAQs

Who is eligible to avail of the benefits of the Kisan Credit Card Scheme (KCC)?

All the farmers of India are eligible to avail the benefits of the Kisan Credit Card Scheme (KCC).

What is the normal interest rate under the Kisan Credit Card Scheme (KCC)?

Normally the interest rate under the Kisan Credit Card Scheme (KCC) is 2% to 4% for the loan amount up to 3 lakh.

What are the age criteria to apply for the Kisan Credit Card Scheme (KCC)?

All the farmers of India who are between the age group of 18 to 75 years are eligible to avail the benefits of the Kisan Credit Card Scheme (KCC).

How much collateral did the farmers have to pay to avail of the loan under the Kisan Credit Card Scheme (KCC)?

There are no Collateral fees to be given by the farmers to avail of the loan under the Kisan Credit Card Scheme (KCC).

Which nodal department is administrating the works of the Kisan Credit Card Scheme (KCC)?

The Ministry of Agriculture and Farmers Welfare is the nodal department is administrating the works of the Kisan Credit Card Scheme (KCC).

When was the Kisan Credit Card Scheme (KCC) originally launched? The Kisan Credit Card Scheme (KCC) was originally launched in August 1998