A National Pension system launched the Atal Pension Yojana (APY) in the Union Budget for 2015–2016. Those working in the unorganized sector are the target population for this pension plan. Private sector workers without pension benefits are also eligible. Upon reaching the age of sixty, a person may be eligible to receive a pension of Rs. 1,000, Rs. 2,000, Rs. 4,000, or Rs. 5,000, depending upon their contribution to the system and the age at which they began their subscription. If both the provider and the spouse pass away, the person nominated may also be eligible to receive the Atal Pension Yojana (APY) funds.

Overview of APY

A pension scheme known as the Atal Pension Yojana also known as APY was announced in the Union Budget for 2015–2016, with a focus on those working in the unorganized sector. The Indian government supports the Atal Pension Yojana (APY), formerly known as the Swavalamban Yojana (Self-Support Scheme), which is a pension plan designed mainly for the unorganized sector. The program was formally introduced by Prime Minister Narendra Modi on May 9, 2015, in Kolkata, after Finance Minister Arun Jaitley announced during the 2015 budget speech. Enrollment in the APY has passed 6 crores, with over 79 lakh new registrations this financial year, according to PIB data as of December 12, 2023.

Important Factors

| Name of the scheme | Atal Pension Yojana APY |

| Launched by | Central Government of India |

| Beneficiaries | Citizens of the Country |

| Benefits | Under this Scheme the government will provide pensions to the citizens |

| Application Mode | Both Offline and Online |

| Year | 2024-25 |

| Official website | https://enps.nsdl.com/ |

Objective of APY

The primary objective of the APY is to provide a pension fund to the people who need it in their old age. The Indian government’s Atal Pension Yojana, or APY for short, is a pension scheme aimed at workers in the unorganized sector. Its main objective is to give people who have retired from their professional professions and are no longer employed financial security. Those working in the unorganized sector are the target population for this pension plan. Private sector workers without pension benefits are also eligible. This pension scheme will help the beneficiaries in securing their future at the age where they are not in a situation to earn money.

Pension Amount

- Pension amount of Rs 1000, 2000, 3000, 4000 and 5000 depends on the contribution rate selected by the subscriber and regular payment made during the accumulation period.

APY Benefits

- At the age of sixty, your pension will be at least ₹1,000, ₹2,000, ₹3,000, ₹4,000, or ₹5,000 per month, depending on the quantity and age of your specified contributions.

- You’ll get a bigger pension if the real investment returns outpace the projected returns.

- Government co-contributions are given to qualified subscribers, increasing their pension corpus.

- Under Section 80CCD (1) of the Income Tax Act, contributions made to the APY are deductible from taxes.

- Your spouse may choose to continue making contributions or get the entire amount of the accrued pension asset as a lump sum if you pass away before turning 60.

- Following your 60th birthday, your spouse continues to receive your pension until they pass away, at which point the nominee becomes the beneficiary of the total pension asset.

Contribution of Government

- To encourage early enrollment and provide further support, the government pays qualified subscribers a co-contribution. For the first five years of the plan, this co-contribution is ₹1,000 per year, or 50% of the subscriber’s contribution, whichever is smaller.

- Members of the program who enlisted between June 1, 2015, and March 31, 2016, are eligible for this as long as they are not eligible for coverage under another social security program or are exempt from income tax.

Contribution Chart

| Age of Entry | Years of Contribution | Monthly Pension of ₹1,000 (Indicative Corpus: ₹1.70 lakhs) | Monthly Pension of ₹2,000 (Indicative Corpus: ₹3.40 lakhs) | Monthly Pension of ₹3,000 (Indicative Corpus: ₹5.10 lakhs) | Monthly Pension of ₹4,000 (Indicative Corpus: ₹6.80 lakhs) | Monthly Pension of ₹5,000 (Indicative Corpus: ₹8.50 lakhs) |

| 18 | 42 | 42 | 84 | 126 | 168 | 210 |

| 19 | 41 | 46 | 92 | 138 | 183 | 228 |

| 20 | 40 | 50 | 100 | 150 | 198 | 248 |

| 21 | 39 | 54 | 108 | 162 | 215 | 269 |

| 22 | 38 | 59 | 117 | 177 | 234 | 292 |

| 23 | 37 | 64 | 127 | 192 | 254 | 318 |

| 24 | 36 | 70 | 139 | 208 | 277 | 346 |

| 25 | 35 | 76 | 151 | 226 | 301 | 376 |

| 26 | 34 | 82 | 164 | 246 | 327 | 409 |

| 27 | 33 | 90 | 178 | 268 | 356 | 446 |

| 28 | 32 | 97 | 194 | 292 | 388 | 485 |

| 29 | 31 | 106 | 212 | 318 | 423 | 529 |

| 30 | 30 | 116 | 231 | 347 | 462 | 577 |

| 31 | 29 | 126 | 252 | 379 | 504 | 630 |

| 32 | 28 | 138 | 276 | 414 | 551 | 689 |

| 33 | 27 | 151 | 302 | 453 | 602 | 752 |

| 34 | 26 | 165 | 330 | 495 | 659 | 824 |

| 35 | 25 | 181 | 362 | 543 | 722 | 902 |

| 36 | 24 | 198 | 396 | 594 | 792 | 990 |

| 37 | 23 | 218 | 436 | 654 | 870 | 1,087 |

| 38 | 22 | 240 | 480 | 720 | 957 | 1,196 |

| 39 | 21 | 264 | 528 | 792 | 1,054 | 1,318 |

APY Calculator

Monthly investment: ₹76

Investment duration: 35 yrs

Total amount: ₹31,920

Salient Features

- Upgrade/Downgrade: Beginning on July 1st, 2020, you will be able to adjust the amount of your pension once a year.

- Printing Your PRAN Card: Use our online tool to download and print your Permanent Retirement Account Number (PRAN) card.

- Spouse Continuation: In the event of the subscriber’s death, spouses may go on with the account.

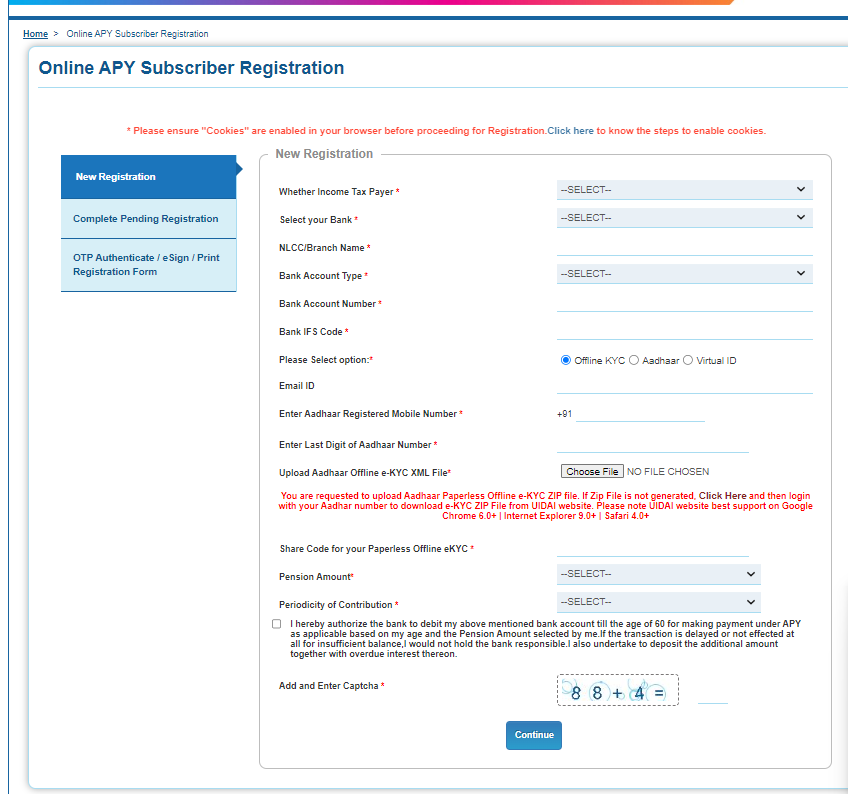

- Digital Onboarding (APY@eNPS): To gain more access, enroll online via eNPS.

- Grievance Module: File online inquiries and keep track of complaints.

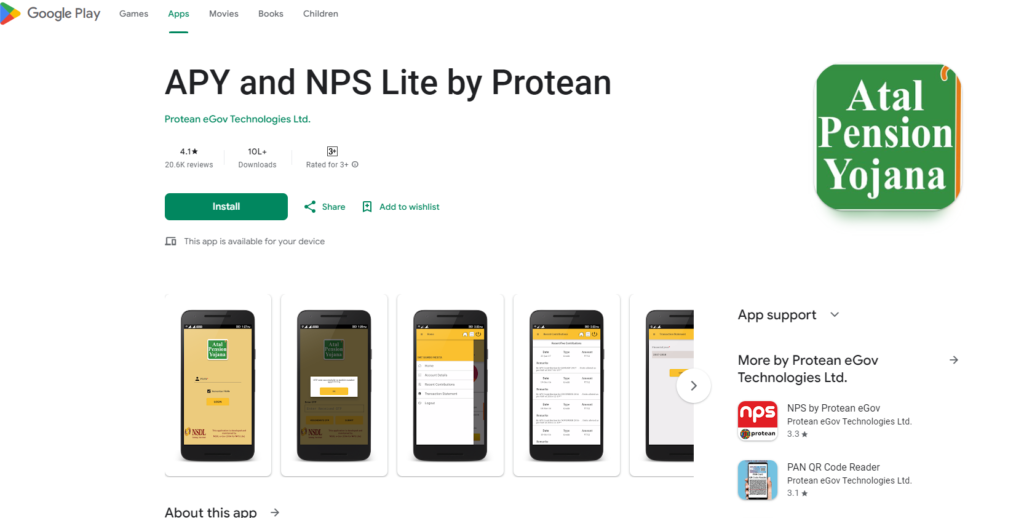

- Mobile App: To see your account information, transaction history, and most recent donations, download the APY mobile app.

Maturity and Withdrawal Rules

- The guaranteed minimum pension amount that you choose at enrollment will be paid to you.

- You’ll get a larger pension if the real investment returns outperform the projected returns.

- Your spouse will continue to get the same pension after your death until they pass away.

- The nominee inherits the total pension asset upon the death of both the nominee and the deceased spouse.

Atal Pension Yojana Enrollment Process

To apply, take the actions listed below:

Step 1: Go to the branch where your savings bank account is located. Create an account if you don’t already have one.

Step 2: With help from the bank employees, complete the APY registration form online and include the bank account number.

Step 3: Submitting your Aadhaar and mobile phone details is the next step. Although not required, providing this information facilitates updates and communication.

Step 4: The last thing to do is make sure you have enough money in your savings account to cover the half-yearly, quarterly, and monthly contributions.

Download Registration Form

If you do not already have the application form, you can get it from the internet by doing the following steps:

Step 1: You must first visit the official NPS website.

Step 2: When you click “home” on the homepage, drop-down menus will show up. Click on the Atal Pension Yojana (APS) link from them.

Step 3: Click on Forms in the newly opened window.

Step 4: Upon clicking, a new window with the registration form in multiple languages and PDF format will appear. You might choose to download the APY Subscriber Form.

Step 5: Correctly fill out the form and send it to the post office or bank branch.

Check APY Enrollment Details NPS CRA Portal

Step 1: Go to the NPS CRA website.

Step 2: Now, under the home menu, click on APY.

Step 3: Next, click on “APY e-PRAN/Transaction Statement View.”

Step 4: A new window opens, where you have two options:

With PRAN:

- Enter your 12-digit Permanent Retirement Account Number (PRAN).

- Provide your bank account details.

Without PRAN:

- Enter your bank account number.

- Provide your name.

- Enter your date of birth.

Step 5: Choose either “Statement of Transaction View” or “APY e-PRAN View” under the “Views for Subscriber” section.

Step 6: Enter the captcha code and submit to view your enrollment details and transaction history.

By Mobile App

Step 1: Download the “APY and NPS Lite” mobile application from the App Store.

Step 2: Log in with your PRAN details and the OTP received on your registered mobile number. View your transaction statement, total holdings, asset allocation, and other account details on the homepage.

Offline Process

Step 1: Visit the branch where you enrolled in APY.

Step 2: Request the bank/post office staff to provide you with your enrollment details and transaction history.

Contact Details

- Call the toll-free number 1800 889 1030 to inquire about your enrollment details.

FAQS

What is Atal Pension Yojana (APY)?

A National Pension Scheme (NPS) known as the Atal Pension Yojana (APY) was unveiled in the Union Budget for 2015–2016.

What are the benefits of this scheme?

An individual worker is eligible to receive a pension of Rs. 1,000, 2,000, 4,000, or 5,000 at age 60.

Who is the organizing body for the APY?

PFRDA

Who can apply for this scheme?

Those working in the unorganized sector are the target population for this pension plan. Private sector workers without pension benefits are also eligible.

What is the pension amount?

Pension amount of Rs 1000, 2000, 3000, 4000 and 5000 depends on the contribution rate selected by the subscriber and regular payment made during the accumulation period.