This is to notify all the meritorious students of India that the Union Cabinet announced the PM Vidyalakshmi Scheme for talented students. In this scheme, the government aims to ease the financial burden on students and their parents by providing loans for their higher education. This scheme not only provides collateral-free loans from government-registered banks and financial institutions but also covers all educational expenses including tuition fees, books, and other related costs of deserving students in India.

With the help of these loans, students are not only able to pursue their higher education in their respective fields of interest without any financial obstacles but also empower them to perform better in their prospects. If you’re a meritorious student of India and belong to a financially unstable background and due to this you are not able to pursue your higher education and wish to avail the benefits of this PM Vidyalakshmi Scheme. Read the article below for complete information about PM Vidyalakshmi Scheme.

Important Factors

This PM Vidyalakshmi Scheme is specially designed for those meritorious students of India who are admitted in Quality Higher Education Institutions (QHEI). In this program selection of Beneficiaries is determined by a ranking called NIRF rankings in overall category-specific and domain-specific rankings which include government as well as private top-quality higher education institutions of the nation. This PM Vidya Lakshmi is a type of renewal scheme that renews every year. With the help of this renewal advantage, meritorious students can renew their PM Vidyalakshmi Scheme each year and benefit from this Scheme till the end of their higher courses.

Objective of PM Vidyalakshmi Scheme

The primary objective behind this PM Vidyalakshmi Scheme is to provide financial support to meritorious students of India in the form of free collateral loans so that students can pursue their higher qualifications without any financial constraints. This scheme plays a significant role in those students who are struggling with financial troubles and are unable to pursue their higher education by providing higher educational loans to them that cover all educational expenses like tuition fees, examination fees, and other expenses related to their course. Through this scheme, meritorious students are not only able to continue their higher studies but also facilitate them to secure brighter career opportunities in future goals.

Budget for PM Vidyalakshmi Scheme

- Under this PM Vidyalakshmi Scheme a total budget of Rs 3600 crore has been created during the years 2024-25 up to 2030-31.

Eligibility Criteria

To be eligible for the PM Vidyalakshmi Scheme, the applicant must meet the following eligibility criteria’s these are as mentioned below

- Applicant must be a permanent resident of India.

- Applicant must be engaged either in any technical or professional courses from a recognized government institution in India.

- Applicant must have their bank account linked with an Aadhar card.

- Applicant must not involved in any other government schemes.

- The annual income of the applicant’s family must not be more than Rs 8.00 lakhs per annum from all sources.

Benefits of the PM Vidyalakshmi Scheme

There are many benefits under this PM Vidyalakshmi Scheme some of which are mentioned below

- This scheme provides free collateral loans up to Rs 10 lakhs to meritorious students of India.

- This scheme covers all education-related expenses including tuition fees, books, and other costs of deserving students.

- Through this scheme government aims to empower meritorious students by providing financial support in the form of guarantee loans.

- This scheme starts with 860 qualifying Higher Education Institutions and covers more than 22 lakhs meritorious students who wish to pursue their higher studies by availing loans.

- Under this program, every year 1 lakh students are selected as per their NIRF rankings.

- With the help of this financial support, meritorious students of India who are suffering from financial issues and are not able to receive quality higher education get an opportunity by getting free collateral loans.

- In this scheme, meritorious students can receive their loans through an E-voucher or (CBDC) in India.

Required Documents

- Aadhar Card

- Resident Proof

- Birth Certificate

- Bank Details

- Income Certificate

- Marksheet of Previous Examinations

- Passport Sized Photograph

- Phone Number

No of Students

- This PM Vidyalakshmi Scheme covers more than 22 lakhs students every year and provides financial loans to meritorious and deserving students of India.

Educational Institutions Covered

- This scheme is available for all top-quality higher education institutions in India which are determined by the NIRF rankings.

- Under this PM Vidyalakshmi Scheme both Government HEI and private are covered which are ranked within the top 100 in overall category-specific and domain-specific in NIRF rankings.

- This PM Vidyalakshmi Scheme not only enclosed State Government High Education Institutions ranked between 101 to 200 but also covered Central Government institutions based on NIRF.

Loan Amount and Interest Subvention

- Under this program, deserving students will receive a credit guarantee of 75% of outstanding default for a loan amount up to Rs 7.5 lakhs.

- This scheme also provides interest Subvention support of 3 % for loan amounts upto Rs 10 lakhs during the duration of Difficult time/moratorium period to meritorious students of India.

- This scheme provides interest subvention support to 1 lakh students per year for 7 years.

- Under this scheme payment of interest subvention is done through E-voucher and Central Bank Digital Currency wallets.

Selection Process

- Check Eligibility: First of all, interested students must check their eligibility before applying.

- Academic Excellence: The applying candidate must have a strong academic record the scholarship is awarded based on academic merit and talent.

- Submission of Application: First of all, eligible candidates must fill out the application form through the official website designed by the PM Vidyalakshmi Scheme.

- Verification of Documents: In this step, all the filled details are checked by the officials either the details are valid or not.

- Preparation of Merit List: Once the checking process is over, a merit is prepared by the top authorities which includes the academic performance, and family income of the applying student.

- Announcement of Results: This declaration of results is done by the officials Publicly.

- Loans Disbursement: After the announcement of results eligible students are ready to get their loan amount, and the amount will be transferred through an E-voucher or (CBDC) wallet.

Application Process

To avail of the benefits of the PM Vidyalakshmi Scheme applicant needs to follow some simple steps these are as mentioned below:

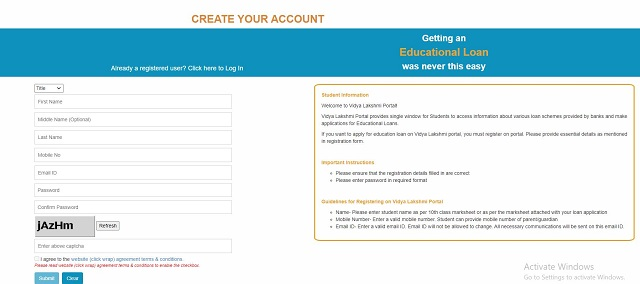

Step 1: After clearing, all the eligibility criteria applicants must visit the PM Vidyalakshmi Portal of India.

Step 4: Click on the New User Registration option, if you are applying for the first time.

Step 3: After that applicant needs to create a “New Account” by filling in their details like Name, Email, mobile number, etc.

Step 4: A verification link is sent to the applicant’s registered email address Now applicant needs to click on the Activation Link to verify or activate their account.

Step 5: Now applicant needs to click on the Search and Apply for Loan option.

Step 6: After that applicant needs to select their country, course, and loan amount as per their need.

Step 7: Now applicant needs to choose three preferred banks to apply for the scheme.

Step 8: After that applicant needs to enter all the asked details, and attach all the relevant documents with the application form.

Step 9: Once quickly review all the entered details carefully.

Step 10: Now the applicant needs to click on the submit option to complete their application process before the deadline.

FAQs

Q. Which department of India announced this Scheme?

The Higher Education Department of India announced this PM Vidyalakshmi Scheme.

Q. Is this scheme only available to citizens of India?

Yes, this PM Vidyalakshmi Scheme is only available for citizens of India.

Q. What are the benefits of the PM Vidyalakshmi Scheme?

This scheme provides free collateral loans up to Rs 10 lakhs to deserving students of India. It covers all education-related expenses including tuition fees, books, and other costs of deserving students.

Q. What is the full form of NIRF and CBDC?

The full forms of NIRF and CBDC are the National Institutional Ranking Framework and Central Bank Digital Currency respectively.

Q. Can a student whose family income is more than Rs.8.00 lakh apply for this scheme?

No, only students whose family income is less than Rs. 8.00 lakh can apply for the PM Vidyalakshmi Scheme.