In India, there is a full indirect tax system called the Goods and Services Tax (GST). Both individuals and businesses must register for GST to function under this. The GST Portal is easily accessible online by taxpayers with permission from the Indian Government to register for GST. With your ARN or SRN number, you can do the GST Status Check very easily by visiting the online portal. You may do the GST Status Check by ARN and follow the progress of your application with this special number. All the citizens who have registered for GST can easily see the status of their application with a few easy steps. Keep reading for more.

Overview of Goods and Services Tax (GST)

The Goods and Services Tax is commonly referred to as GST. In India, it is an indirect tax that has taken the place of numerous other indirect taxes, including services tax, VAT, and excise duty. On March 29, 2017, the Parliament passed the Goods and Service Tax Act, which became operative on July 1st, 2017. It is a destination-based tax on the products and services that are consumed. It is suggested that taxes be imposed at every stage, from production to ultimate consumption, with the ability to set off taxes paid at earlier phases. To put it briefly, the final consumer will be responsible for paying the taxes on value addition alone.

Important Factors

| Name of the article | GST Status Check |

| Launched by | The government of India |

| Beneficiaries | The taxpayer citizens of India |

| Nodal Department | Ministry of Finance |

| Mode of application | Online and offline |

| Official website | https://services.gst.gov.in/ |

Type of Registration Status

| Status | Description |

| Provisional | Your application has been submitted but has not yet been processed. A provisional ID may have been issued. |

| Pending for Verification | Your application is being reviewed and verified by the GSTN. |

| Validation Against Error | There are errors in your application that need to be corrected before it can be processed further. |

| Migrated | Your application for migration from an earlier tax regime to GST has been successful. |

| Canceled | Your application has been rejected due to incorrect or incomplete information. You can reapply after rectifying the errors. |

| Approved | Your application has been approved, and you have been assigned a unique GSTIN. |

Check GST Status By ARN, SRN/FRN (Without Login)

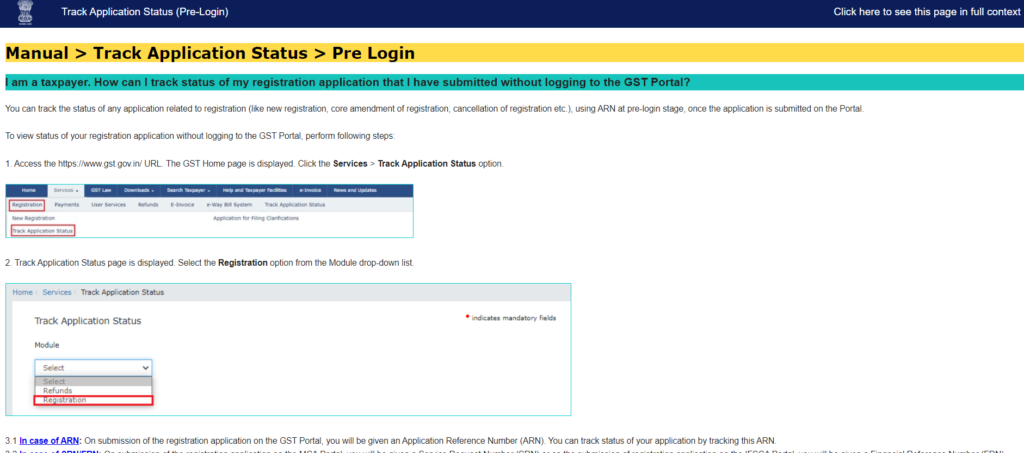

Step 1: Click the gst.gov.in link to access the official GST portal.

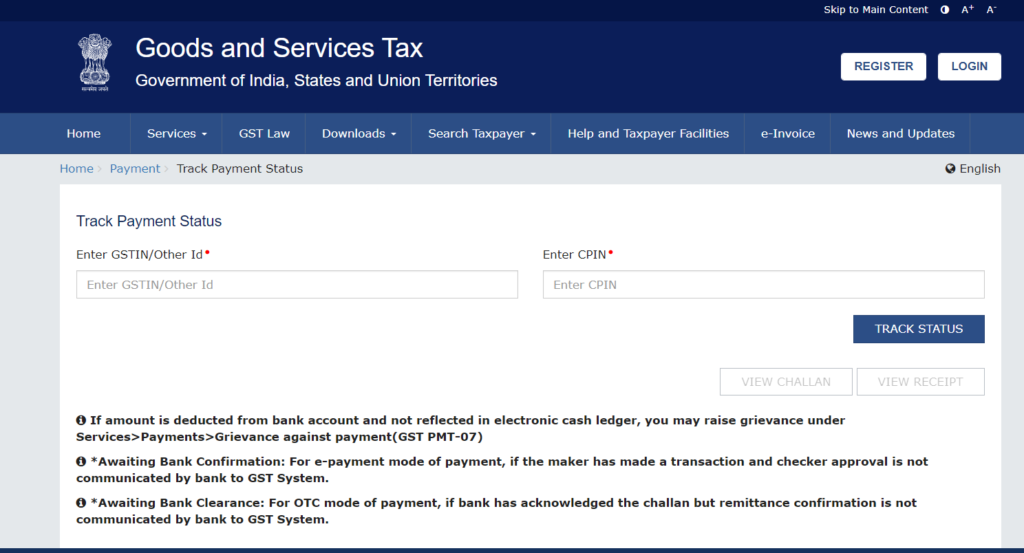

Step 2: Select “Track Payment Status” under the “Services” option on the homepage.

Step 3: Select “registration” from the drop-down option when a new window opens.

Step 4: Enter the ARN that you were given when you submitted your application.

Step 5: The application status—approved, denied, or pending—will be shown on the portal.

Check GST Status By ARN, SRN/FRN (With Login)

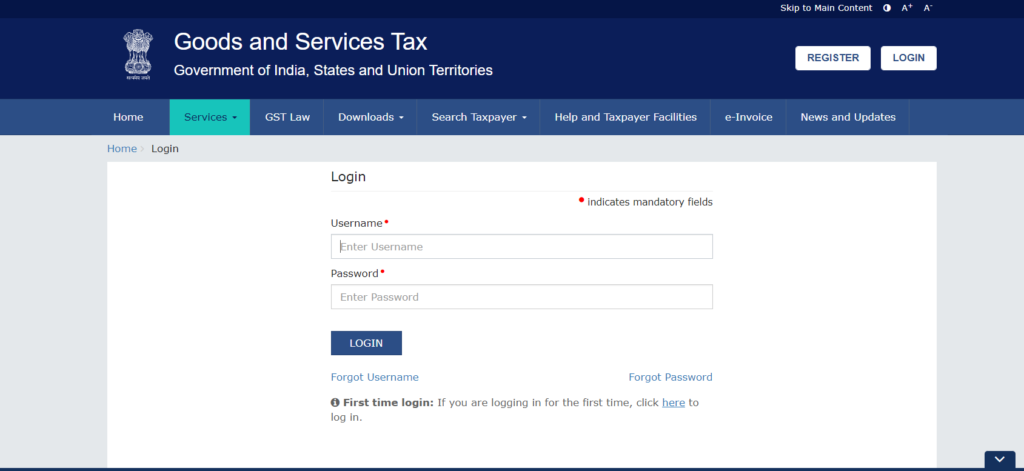

Step 1: Enter your login information to enter the GST portal.

step 2: is to click the “Services” tab and choose “Track Application Status.”

Step 3: You can use the ARN or the date range that the application was submitted to look for your application.

Step 4: The application status and other pertinent information will be shown on the site.

Detail Covered Under Status Dashboard

- ARN/SRN

- Form No

- Form description

- Submission date

- Status

- Assigned to

Contact Details

- Help Desk Number: 1800-103-4786

- Log/Track Your Issue: Grievance Redressal Portal for GST

FAQS

What is GST?

In India, there is a full indirect tax system called the Goods and Services Tax (GST).

How is it implied in India?

Both individuals and businesses must register for GST to function under this.

How can we register for GST?

By visiting the online GST portal

How can we check the status of GST?

With your ARN or SRN number, you can do the GST Status Check very easily by visiting the online portal.

What are the documents needed for GST?

ARN/SRN or FRN