The Government of India launched the Goods and Services Tax (GST). Goods and Services Tax or GST is a type of indirect tax that was introduced by the government of India to reform the Indian tax structure significantly. By launching GST the Government of India eliminated a bunch of taxes that were levied by the state and Central Government. In simple words, GST eliminated all the complex tax works in India and just combined all the taxes in one which is now called GST. The central government of India also launched a GST portal that helps the citizens of India to register, login, or check their GST status online from the comfort of their homes.

About GST

The GST tax is a unified indirect tax that the government of India levies on the sales of various goods and services in India. The mean Tax slab that the GST replaced is the Value Added Tax (VAT) tax that was levied by the government on the same commodities as GST. According to the Government of India, the GST tax is levied on consumption rather than the production of any commodity. The minimum percentage of GST which is 0% is levied on essential commodities like food items, books, and newspapers. The maximum percentage of GST which is 28% is levied on luxury commodities like luxury cars, tobacco products, and aerated drinks.

Important Factors

| Name of Scheme | Goods and Services Tax (GST) |

| Launched By | Government of India |

| Date of Launch | July 1, 2017 |

| Beneficiary | Business owners |

| Objective of Scheme | Remove a bunch of taxes |

| Nodal Department | Central Board of Indirect Taxes and Customs (CBIC) |

| State | All State of India |

| Benefits | Provides single tax |

| Mode of Application | Online |

| Official Website | https://www.gst.gov.in/ |

Eligibility Criteria

- Individuals or entities who have an expected turnover of more than INR 40 lakh are eligible.

- All the interstate businesses regardless of the turnover are eligible.

- E-commerce sellers, irrespective of turnover.

- All the casual taxable persons who are operating seasonally are eligible.

- Entities opting for voluntary registration.

Objective

The main objective of launching the Goods and Services Tax (GST) is to simplify the process of taxation in India significantly. The most important feature of launching the GST is to promote economic integration, reduce tax evasion, and boost the country’s overall economic efficiency. The Prime Minister of India Mr Narendra Modi announced the launch of GST on 1st July 2017. The Central Board of Indirect Taxes and Customs (CBIC) works under the ministry of the department to administer all the works of GST. According to the Prime Minister of India, the motto of launching GST is “One Nation, One Tax”.

Type of GST Registration

- Normal Taxpayer: All the normal taxpayers who are citizens of India and are running their business operations in India with no deposit requirement and unlimited validity.

- Composition Taxpayer: Under this registration, the citizen is enrolled under the GST composition scheme that allows them to make payment of a flat GST rate with no input tax credit.

- Casual Taxable Person: This type of registration is best for those citizens who are operating temporary stalls or shops and require a deposit equal to the GST liability.

- Non-Resident Taxable Person: This registration is only available to individuals who are living outside India and supplying taxable goods/services to Indian presidents with a deposit equal to liability.

Silent Features

- One Nation, One Tax- With the help of GST the Government of India eliminated a lot of different kinds of indirect tax, creating uniformity and clarity in the indirect tax system in India.

- Different for state and central- By introducing CGST, SGST, and IGST the Government of India has differentiated and equally distributed the GST to the state and Central Government.

- Consumption not production- The GST is levied at the point of consumption rather than the production of any good or services making a seamless flow of tax credits across the supply chain.

- Input Tax Credit (ITC)- All businesses that have a valid GST certificate can file claim credits for taxes paid on inputs.

Required Documents

- Proof of Constitution of Business (e.g., Certificate of Incorporation)

- Passport-sized photos of the applicant and authorized signatory

- Proof of appointment of authorized signatory

- Proof of principal place of business (e.g., Electricity Bill)

- Details of bank accounts (e.g., First page of Pass Book)

- Additional documents may be required based on the nature of the business.

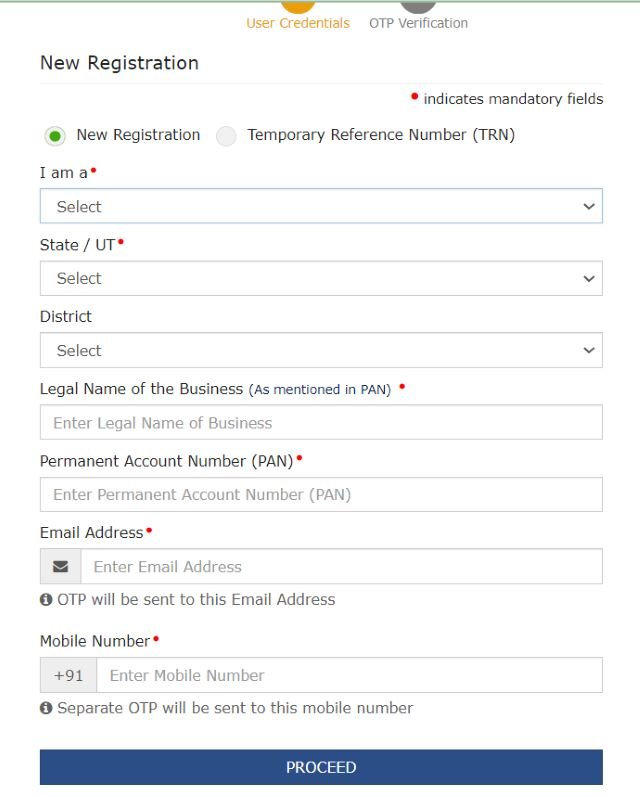

Goods and Services Tax Registration

STEP 1: All business owners of India who want to register under the Goods and Services Tax are requested to visit the official GST website by clicking on the link here.

STEP 2: Once the business owner reaches the homepage of the official website they must locate and click on the option called “register”.

STEP 3: A registration form will appear on your desktop screen the business owners must correctly fill out the registration form and click on the option “proceed”.

STEP 4: Now the business owners must complete the OTP verification by entering the OTP that they have received and clicking on the option “submit” to generate their TRN number.

STEP 5: Now the business owners must log in to the official portal by using their TRN number.

STEP 6: Now on the new page the business owners must enter their information including trade name, constitution of business, contact details, address, top 5 goods and services supplied, and HSN or SAC codes.

STEP 7: Now finally the business owners can enter their bank account details and click on the option “submit” to complete their process.

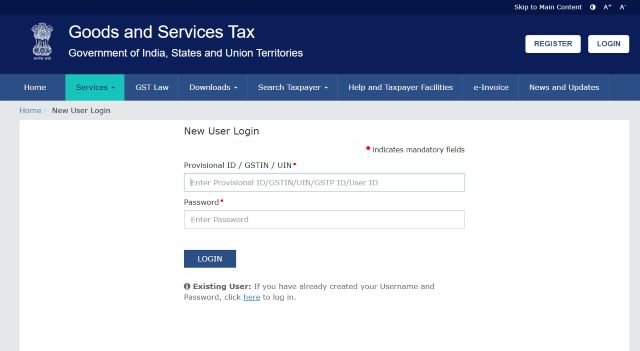

First Time User Login

STEP 1: All business owners who want to login to the official GST portal as first-time users are requested to visit the official website by clicking on the link here.

STEP 2: Once the business owners reach the homepage of the official website they must locate and click on the option called “login”.

STEP 3: A new page will appear on your desktop screen the business owners must click on the option called “If you are logging in for the first time, click here”.

STEP 4: Now the business owners must enter their Provisional ID / GSTIN / UIN and password and click on the option “login” to complete their process.

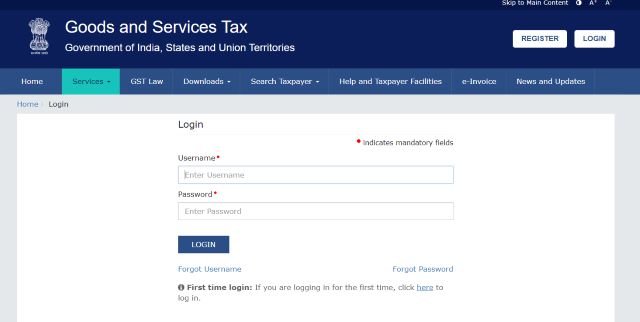

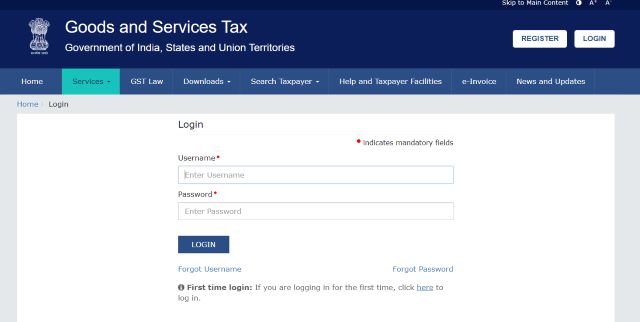

Existing User Login

STEP 1: All business owners who have already registered under the GST portal are requested to visit the official website to do the login process.

STEP 2: Once the business owners reach the homepage of the official website they must locate and click on the option called “login”.

STEP 3: A new page will appear on your desktop screen the business owners must enter their username, password, and captcha code.

STEP 4: After entering all the details the business owners must quickly review it and click on the option “login” to complete their process.

Registration Status

STEP 1: All business owners who want to check the GST registration status online are requested to the official website by clicking on the link here.

STEP 2: Once the business owners reach the homepage of the official website they must click on the option “track status” available under the heading “registration” under “services”.

STEP 3: A new page will appear on your desktop screen the business owners must enter their ARN or SRN number.

STEP 4: After entering all the details the business owners can click on the option “search” to complete their process.

Download GST Certificate

STEP 1: All business owners who want to download their GST certificates online are requested to visit the official website by clicking on the link here.

STEP 2: The business owners must login on to the official portal by using their credentials.

STEP 3: The dashboard will appear on your desktop screen the business owners must click on the option called “View/Download Certificates”.

STEP 4: You will see a list of all your certificates, arranged chronologically (newest to oldest).

STEP 5: The business owners can click on the “download icon” that is available under the heading download to successfully download their GST certificate.

Search Tax Payer By GSTIN/UIN, PAN, Temporary ID and Composition Taxpayer

STEP 1: All business owners who want to search taxpayers on the official website by using their GSTIN/UIN, PAN, Temporary ID, and Composition Taxpayer are requested to visit the official website.

STEP 2: Once the business owners reach the homepage of the official website they must click on the option “search taxpayers” and a bunch of options will appear on your desktop screen.

STEP 3: The business owners can click on any one of the following options to search taxpayer GSTIN/UIN, PAN, Temporary ID, and Composition Taxpayer.

STEP 4: After clicking on any one of the following options a new page will appear on your desktop screen the business owners must enter whatever the information asked.

STEP 5: After entering all the details the business owners must quickly review it and click on the option “submit” to complete their process.

GST Primary Tax Slab

| GST Rate | Goods and Services |

| 0% | Essential goods and services, including basic food items, books, and newspapers |

| 5% | Commonly used products and services like apparel under a certain price, packaged food items, and household necessities |

| 12% | Goods and services including processed foods, mobile phones, and business-class air travel |

| 18% | Most goods and services like electronic goods, restaurants, and personal care products |

| 28% | Luxury and sin goods such as luxury cars, tobacco products, and aerated drinks, often with an additional cost on top |

Search HSN Code

STEP 1: All the business owners who want to search for their HSN code on the official portal are requested to visit the official website by clicking on the link here.

STEP 2: Once the business owners reach the homepage of the official website they must click on the option “Search HSN Code” available under the heading “User services” under “services”.

STEP 3: On the new page the business owners must enter their HSN code or description.

STEP 4: After entering all the details the business owners can click on the option “search” to complete their process.

Contact Details

- If the business owners want to get more information regarding Goods and Services Tax (GST) they can contact- 1800-103-4786.

FAQs

When was Goods and Services Tax (GST) introduced?

The Goods and Services Tax (GST) was introduced on 1st July 2017.

Which nodal department administrates the works of Goods and Services Tax (GST)?

The Central Board of Indirect Taxes and Customs (CBIC) administrates the works of Goods and Services Tax (GST).

What is the motto of Goods and Services Tax (GST)?

The motto of Goods and Services Tax (GST) is “One Nation, One Tax”.

How much percentage of GST is levied on mobile phones?

12% GST is levied on the sales of mobile phones in India.

Which tax was replaced by GST?

The Value Added Tax (VAT) was replaced by GST.

How many types of GST registrations are their?

There are 4 types of GST registration in In