The citizens of India can now apply for the PAN Card online. A PAN card also known as a Permanent Account number is a government official card that is issued to track the financial transactions of a particular citizen. With the help of the online system of applying for the PAN card the citizen of India can save a lot of time and referred by not visiting any government offices. The citizens of India can use various official portals that are launched by the government of India namely NSDL and UTIITSL to apply for the PAN card online. The citizens of India can also download their e-PAN card using these portals.

Overview of Pan Card

All the citizens who apply for the PAN Card will receive a 10-digit Permanent Account number that is essential for various activities nowadays like opening up a bank account. The Income Tax Department of India has the authority to issue PAN cards for the citizens of India. All the citizens of India who want to apply for the PAN card online have to pay a fees of up to INR 101 at the portal. If the citizens decide to apply for the PAN card by visiting government centres they have to pay a fee of up to INR 107.

Important Factors

| Name of Scheme | PAN Card |

| Launched By | Government of India |

| Date of Launch | 1st July 1975 |

| Beneficiary | Citizens of India |

| Objective of Scheme | Download PAN card online |

| Nodal Department | Income Tax Department |

| State | All States Of India |

| Benefits | Apply for a PAN card easily |

| Mode of Application | Online |

| Official Website |

Required Documents

- Proof of Identity: Aadhaar Card, Voter ID, Driving License, etc.

- Proof of Address: Bank Account Statement, Passport, Voter ID, Driving License, Domicile Certificate issued by the Government, etc.

- Date of Birth Proof: Birth Certificate, Voter ID, Driving License, Matriculation Certificate, Passport, etc.

Application Fee

| Particulars | Mode of Submission of PAN Application | Fees (Inclusive of Applicable Taxes) |

| When a physical PAN card is required | Submitted at TIN facilitation centers/PAN centers or online with physical document submission | Rs. 107 |

| When a physical PAN card is required | Submitted online through paperless modes | Rs. 101 |

| When a physical PAN card is not required (e-PAN card) | Submitted at TIN facilitation centers/PAN centers or online with physical document submission | Rs. 72 |

| When a physical PAN card is not required (e-PAN card) | Submitted online through paperless modes | Rs. 66 |

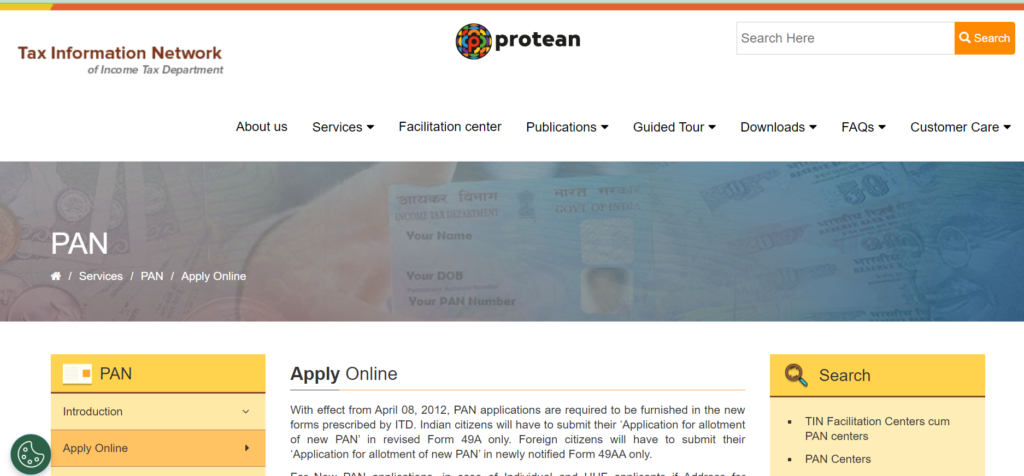

Pan Card Apply Online Through NSDL Portal

STEP 1: All the citizens of India who want to apply for their PAN card using the NSDL portal are requested to visit the official website by clicking on the link here.

STEP 2: On the home page the citizens must use their application form type according to their citizenship status and category.

STEP 3: Now the citizens must enter the rest of the information including their full name, date of birth, email address, and mobile number as requested.

STEP 4: After entering all the details the citizens must quickly review it and click on the option “submit” to reach the next page.

STEP 5: A new page will appear on your desktop screen the citizens must click on the option “Continue PAN application form”.

STEP 6: Now on the new page the citizens must complete the KYC process by entering their personal details contact information, and any other relevant information.

STEP 7: Now the citizens must submit all the documents that are required and the declaration section accurately.

STEP 8: After entering all the details the citizens can click on the option “Apply” to proceed with the application procedure.

STEP 9: To complete the e-KYC process the citizens must enter the OTP that they have received on the registered mobile number with the Aadhar card.

STEP 10: After completing the e-KYC process the citizen can move on to the next step which is the payment.

STEP 11: Once the payment is successful the citizens must authenticate their Aadhar details by ticking the declaration and following the authentication process.

STEP 12: The citizens will receive an OTP on their registered mobile number they must enter the OTP that they have received.

STEP 13: Now the citizens can click on the option “submit”. After submitting the citizens will receive an acknowledgement receipt.

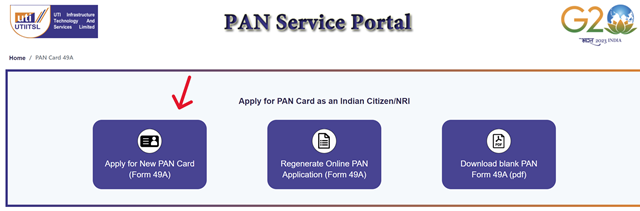

Pan Card Apply Online Through UTIITSL Portal

STEP 1: All the citizens of India who want to apply for their PAN card using the UTIITSL portal are requested to visit the “official website” by clicking on the link here.

STEP 2: Once the citizens reach the homepage of the official website they must locate and click on the option called “Apply for New PAN Card (Form 49A)“.

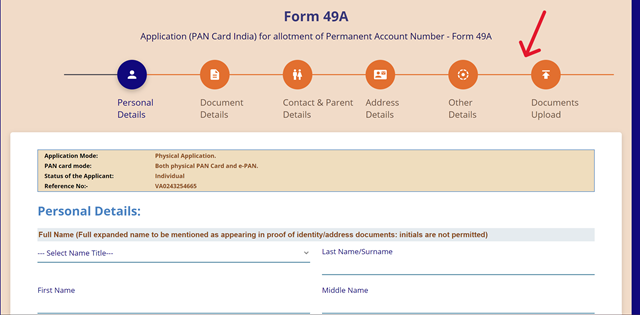

STEP 3: A new page will appear on your desktop screen the citizens must select the “Digital mode” option to complete the entire process online. Then, choose the “status of individual” and click on “submit”.

STEP 4: Now the application form will appear on your desktop screen the citizens must enter all the details that are asked and attach all the necessary documents.

STEP 5: The citizens must complete the payment process by entering their bank account details or any other method they want to complete the payment with.

STEP 6: After completing the payment you will receive an acknowledgement receipt to track your application status.

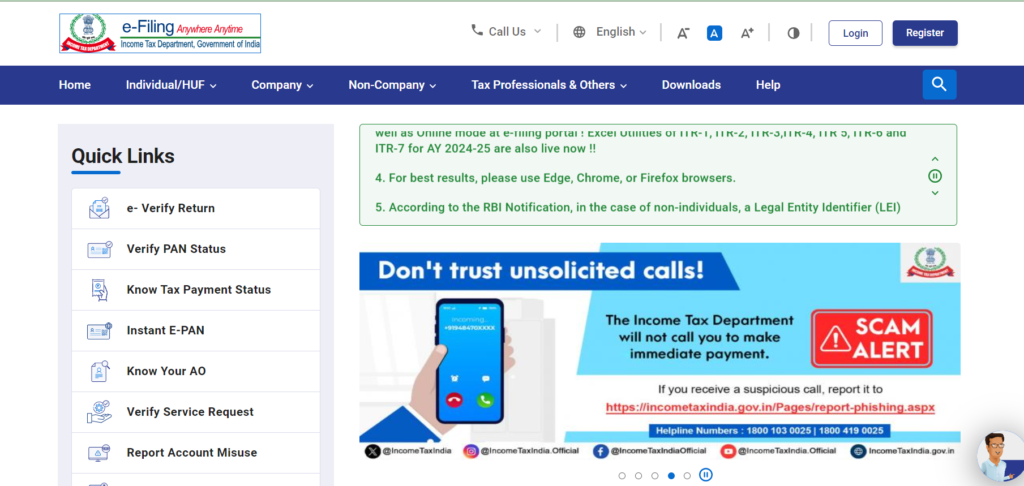

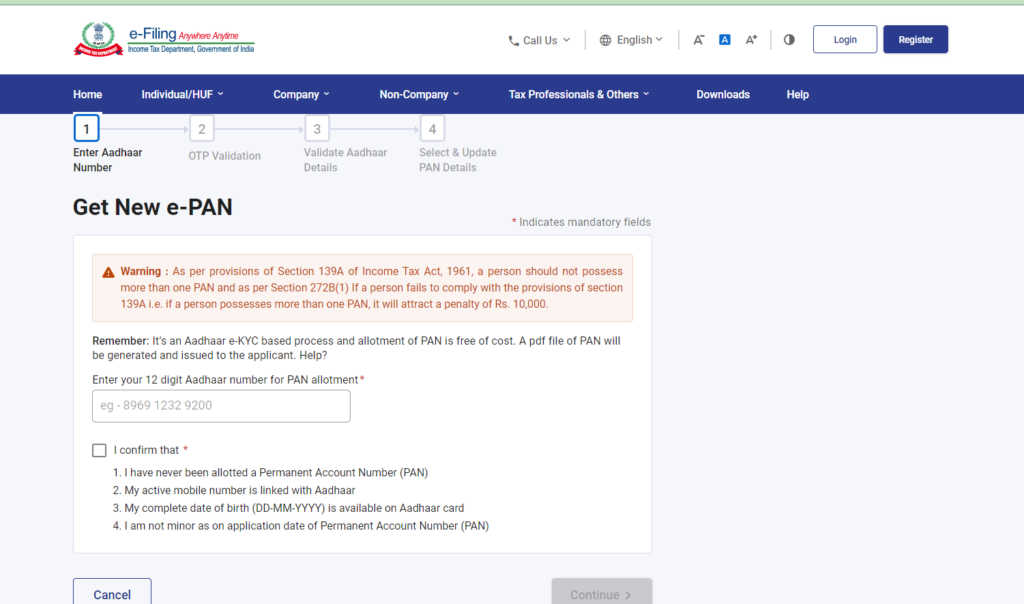

Instant e-PAN Application

STEP 1: All the citizens of India who want to check their e-PAN Status Online are requested to visit the official website by clicking on the link here.

STEP 2: Once the citizens reach the home page of the official website they must locate and click on the option called “Instant e-PAN“.

STEP 3: Now a new page will appear on your desktop screen the citizens must scroll down and click on the option “Get New e-PAN”.

STEP 4: Now the citizens must enter their 12-digit Aadhaar Card number and take the consent box by clicking on the option “continue”.

STEP 5: Now the citizens must enter the OTP that have received on their registered mobile number and click on the option “submit”.

STEP 6: Upon successful submission, a confirmation message will be displayed along with an Acknowledgement Number.

Track Pan Card Status

STEP 1: All citizens who want to check their PAN card status by using the UTIITSL are requested to visit the official UTIITSL website by clicking on the link here.

STEP 2: Once the citizens reach the homepage of the official website they must locate and click on the option “Track PAN Card”.

STEP 3: Now on the new page the citizens must either enter their “PAN Number” or “Application Coupon Number”.

STEP 4: Now the citizens must enter their date of birth along with the captcha code and click on the option “Submit” to complete their process.

Download e Pan Card

STEP 1: All the citizens of India who want to check their e-PAN Status Online are requested to visit the official website by clicking on the link here.

STEP 2: Once the citizens reach the home page of the official website they must locate and click on the option called “Instant e-PAN“.

STEP 3: Now a new page will appear on your desktop screen the citizens must scroll down and click on the option “Check Status/Download PAN”.

STEP 4: On the new page the citizens must enter their Aadhar card number and click on the option “continue”.

STEP 5: Now the citizens must enter all the details that are asked on the new page and click on the option “download” to complete their process.

Helpline Number

- If the citizens need more information regarding their PAN Card they can contact on- utiitsl.gsd@utiitsl.com

FAQs

What is the full form of the NSDL portal?

The full form of the NSDL portal is National Securities Depository Limited.

What is the application fees to apply for the PAN card online?

The application fee to apply for the PAN card online is INR 107.

Which department of India has the authority to issue PAN cards?

The Income Tax Department of India has the authority to issue PAN cards in India.

Who is eligible to apply for the PAN card?

All permanent residence of India who are above the age of 18 years are eligible to apply for a PAN card.

When was the PAN card first introduced?

The PAN card was first introduced on 1st July 1975.

What number is printed on the PAN card?

The permanent account number is the number that is printed on the PAN card.