The Employee Provident Fund (EPF) also known as Provident Fund (PF) is a scheme for all government or corporate employees that provides retirement savings to the employees. Under the employee provident fund, the employer and the employee contribute to collecting the employee’s retirement savings funds. The Employees Provident Fund is registered under the Employees’ Provident Funds Act 1952. Any firm or organization with a minimum of 20 employees must maintain an EPF account for all their employees. Various EPF calculators are available online where the employees can calculate the total amount of their EPF.

EPF Calculator

EPF Calculator

What is the Employee Provident Fund (EPF)?

An Employee Provident Fund (EPF) is the fund that will be given to the employees of any company or firm after the employees retire or leave the respective company. Every month the employer and the employee must contribute 12% of their basic salary towards the EPF account of the employees. Out of the 12%, 8.33% is directed towards Employee Pension Scheme and 3.67% to EPF. However, the employee’s total contribution of 12% goes towards EPF. After the employee retires they are eligible to receive the full amount of their EPF. The Employees’ Provident Fund Organisation (EPFO) is the department that oversees the works of the EPF.

Formula to Calculate EPF Amount

The contributions to the employee provident fund must be made by both the employer and the employee. The employer is obligated to contribute towards the EPF fund. if the employer failed to contribute towards the fund, then it is considered illegal. For example, if any employee is earning up to INR 20,000 including all benefits, then 12% of INR 20,000 that is INR 2400 should be submitted towards the EPF fund. If the Employee Pension Scheme is also eligible for that specific employee, then 8.33% of the 12% will be contributed to the pension scheme. The remaining 3.67% will be contributed to EPF for such employees. The employee must be earning more than ₹18,000 per month to be eligible for the EPF benefits according to the rules and regulations stated by the Indian government.

Silent Features

- Retirement saving: The most important feature of an Employee Provident Fund is that it helps the employee to get a financially stable retirement. The employee can receive their EPF amount in a lump sum after their retirement.

- Estimate EPF: By using various online calculators the employees can easily check their Employee Provident Fund amount by entering some basic details.

- Considerable interest rate: The interest rate under the employee provident fund was set up by the government of India keeping in mind the current state of employees.

- Employer contribution: In the EPF, not only the employees but the employer also contributes some amount accordingly.

Advantages of EPF/PF Calculator

- Easy to use: The user interface of all the online EPF calculators is very easy to use and understand by any employee easily.

- Future income: By easily calculating their EPF amount the employees can plan their retirement accordingly.

- Transferable: By using the universal account number (UAN) the employees can easily transfer their Employee Provident Fund amount from one company to another.

- Automatic interest rate: With the help of automatic interest rate consideration the employees did not have to check the interest rate again and again.

How to Check EPF Balance Online?

STEP 1: All the employees who want to check their EPS balance online are requested to visit the official website by clicking on the link here.

STEP 2: Once the employee reaches the homepage of the official website they must enter all the details that are asked including:

- Current Age

- Retirement Age

- Current EPF Balance

- Employee Contribution

- Employer Contribution

- Growth Rate in EPF Contribution

- Rate of Interest

- Current Pension Fund Balance

STEP 3: After entering all the details the employees must quickly review it and click on the option “Submit” to complete their process.

Check EPF Balance through SMS or Missed Call

STEP 1: All the employees who want to check their EPF balance through sms or missed calls are requested to give a missed call on 011-22901406.

STEP 2: Now the employees will receive an SMS from the authorities where they have to enter their Aadhar number and UAN number.

STEP 3: After completing the KYC with your UAN number the employees will receive an SMS that includes EPF details including the EPF balance.

Check EPF Balance through the Mobile App

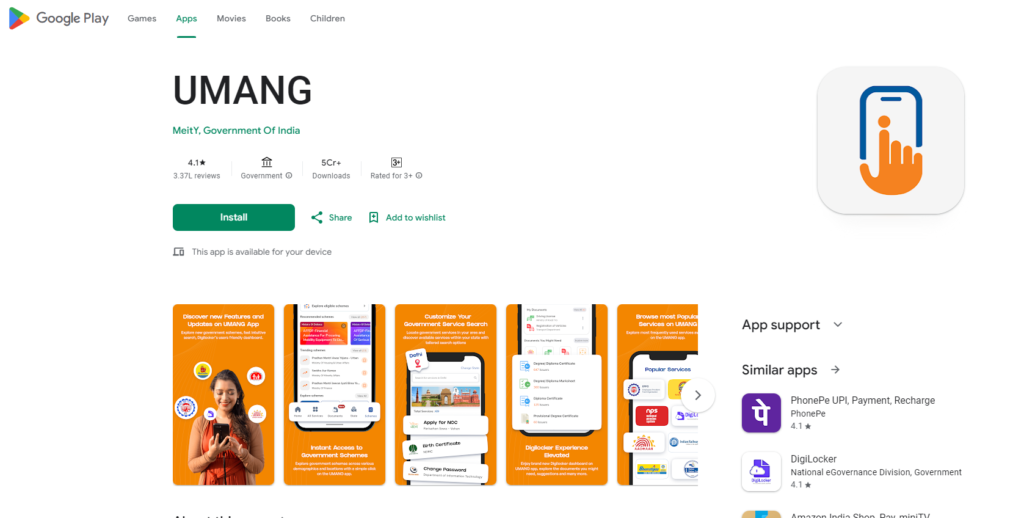

STEP 1: All the employees who want to check their EPF balance through the mobile app are requested to visit their Play Store or App Store and download the Umang app.

STEP 2: After successfully downloading the mobile app the employees must click on the option “passbook” under the heading “Employee Services”.

STEP 3: A new page will appear on your desktop screen the citizens must Now enter their 12-digit UAN number and click on the option “get OTP”.

STEP 4: The employees must now enter the OTP that they have received on the registered mobile number and click on the option “submit”.

STEP 5: Now your Employee Provident fund details will appear on your mobile screen including name, date of birth, Aadhaar number; PAN for a tax deduction, last month’s EPF contribution, etc.

Transfer Money Online

STEP 1: All the employees who want to transfer their money online are requested to visit the official website by clicking on the link here.

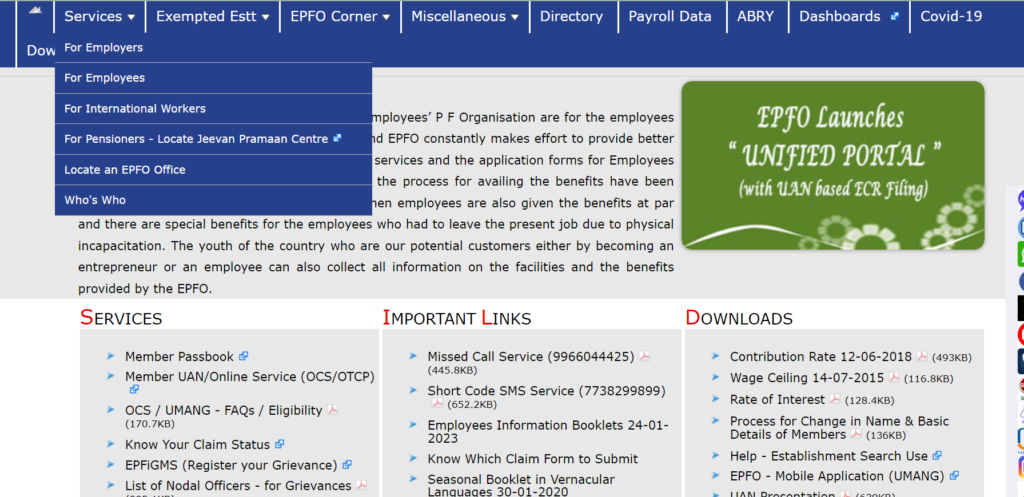

STEP 2: Once the employees reach the homepage of the official website they must click on the option called “Online Transfer Claim Portal (OTCP)” under the heading “FOR EMPLOYEES”.

STEP 3: The application form will appear on your desktop screen the citizens must follow all the instructions and fill out the application form carefully.

STEP 4: After entering all the details the employees must quickly review it enter the captcha code and take on the option “submit” to complete their process.

STEP 5: The employees will be provided with a tracking ID to track their money transfer status online.

FAQs

How much percent the employees have to contribute under the Employee Provident Fund?

A total of 12% of their salary has to be contributed by the employees under EPF.

Under which act EPF is registered?

EPF is registered under the Employees’ Provident Funds Act 1952.

What is required to transfer EPF account money?

The employees just need to have their Universal account number (UAN) to transfer EPF account money.

Which department oversees the functioning of the Employee Provident Fund?

The Employees’ Provident Fund Organisation (EPFO) is the department that oversees the works of the EPF.