The citizens of India can now PAN Card Download online. The citizens of India can use the government’s official websites like NSDL and UTIITSL to download their PAN card online. With the help of the online system of downloading their PAN card online, the citizens did not have to visit any government office and waste their time. The e-PAN card is also considered valid by the government of India because it has all the attributes that the physical PAN card has. To download a PAN card online the citizens of India just need their PAN number or acknowledgement number.

What is Pan Card?

Nowadays, the PAN card has become one of the most useful government official documents that is required in every normal activity like opening up a bank account. The PAN card contains a 10-digit alphanumerical code called a Permanent Account Number (PAN). The PAN card is issued by the Income Tax Department of India. The Income Tax Department of India introduced the e-PAN facility on February 12, 2020, enabling quick online PAN card generation using Aadhaar-based e-KYC, eliminating lengthy paperwork. The citizens of India can get easy loans with the help of their PAN card because the PAN card shows all the financial history and credibility of the citizens.

Important Factors Of PAN Card Download

| Name of Scheme | PAN Card Download |

| Launched By | Government of India |

| Date of Launch | 1st July 1975 |

| Beneficiary | Citizens of India |

| Objective of Scheme | Download PAN card online |

| Nodal Department | Income Tax Department |

| State | All States Of India |

| Benefits | Eliminate long process of downloading for PAN card |

| Mode of Application | Online |

| Official Website | https://www.protean-tinpan.com/ |

Required Documents

- Aadhar Card

- PAN card

Download PAN Card through NSDL

STEP 1: All the citizens of India who want to download their PAN card using the NSDL portal are required to visit the official website by clicking on a link here.

STEP 2: Once the citizens reach the homepage of the official website they must click on the option called “PAN-New facilities” under the heading “Quick Links”.

STEP 3: A drop-down menu will appear on your desktop screen the citizens must select either “Download e-PAN/e-PAN XML (PANs allotted in last 30 days)” or “Download e-PAN/e-PAN XML (PANs allotted before 30 days)” according to their need.

STEP 4: A new page will appear on your desktop screen the citizens must enter their PAN number, Aadhaar details, date of birth, and captcha code along with their PAN number, or Acknowledgement number.

STEP 5: After entering all the details citizens must click on the option “generate OTP” and enter the OTP that have received on the registered mobile number.

STEP 6: Now finally the citizens must review all they are details and click on the option “submit” to complete their process.

Download PAN Card through UTIITSL

STEP 1: All the citizens of India who want to download their PAN card using the UTIITSL are requested to visit the official website by clicking on the link here.

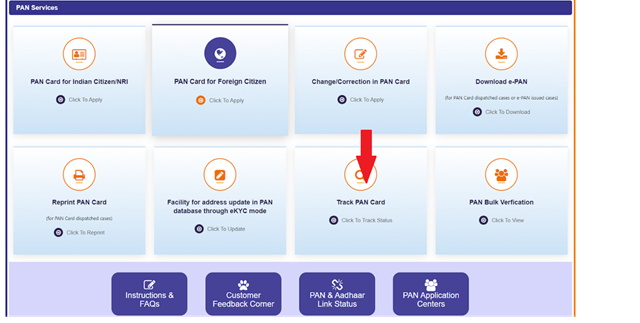

STEP 2: Once the citizens reach the homepage of the official website they must locate and click on the option called “ PAN services”.

STEP 3: A dashboard will appear on your desktop screen that citizens must scroll down and click on the option “Download e-PAN”.

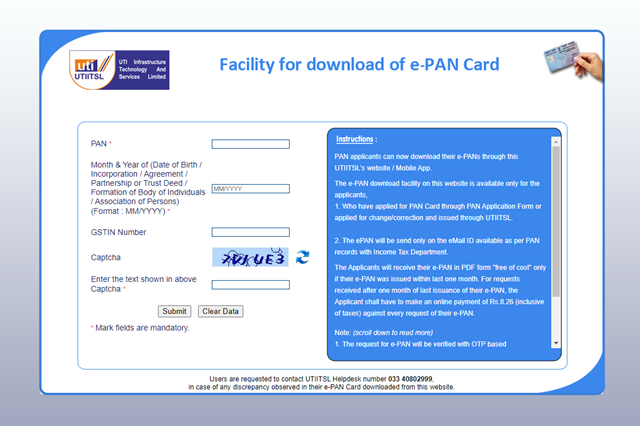

STEP 4: A new page will appear on your desktop screen the citizens must enter all the details including PAN number, date of birth, and GSTIN.

STEP 5: After entering all the details the citizens will receive a download link sent to their mobile number or Email address.

STEP 6: By using the download link the citizens can easily download their PAN card online.

Download PAN Card by an Income Tax e-Filing Portal

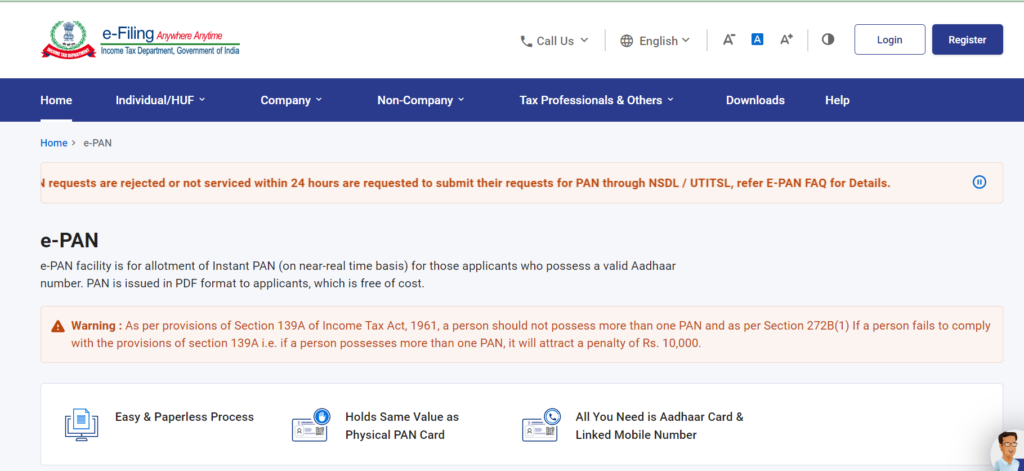

STEP 1: All the citizens of India who want to download their PAN card by using an Income Tax e-filing Portal are requested to visit the official website.

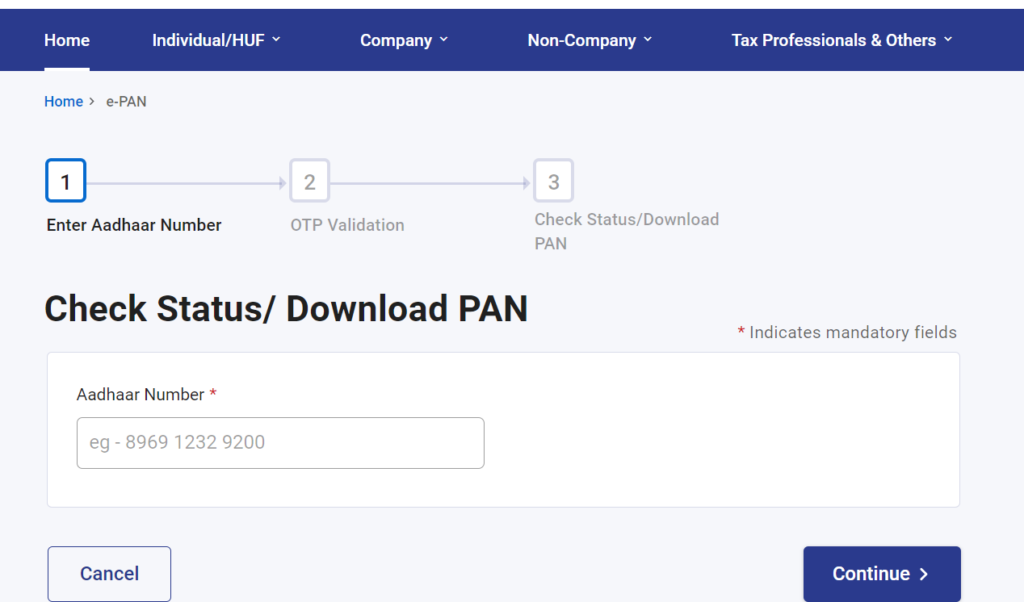

STEP 2: What is the citizens reach the homepage of the official website they must click on the option “instant e PAN” available under the heading “quick links”.

STEP 3: A new page will appear on your desktop screen the citizens must enter their Aadhar card number and click on the option “continue”.

STEP 4: Now the citizens must enter the OTP that they have received on the registered mobile number.

STEP 5: After entering all the details the citizens can now click on the option “Download e-PAN” to complete their process.

Detail Mentioned Under Pan Card

- Name,

- Date of birth

- Father’s or spouse’s name

- Photograph

- PAN number

Contact Details

- If the citizens need more information regarding their PAN Card they can contact on- utiitsl.gsd@utiitsl.com

FAQs

What are the official portals for downloading the PAN card online?

The citizens of India can download the PAN card online by visiting the official portal of NSDL and UTIITSL.

Which department issues PAN cards in India?

The Income Tax Department of India issues PAN cards in India.

What is required to download the ePAN?

They just need their PAN card or acknowledgment number to download the ePAN online.

Who is eligible to apply for the PAN card?

All citizens of India who are above the age of 18 years are eligible to apply for a PAN card.

When was the ePAN card introduced?

The ePAN card was first introduced on 12th February 2020.